The Republic of the Congo, or Congo Brazzaville, is a significant regional hydrocarbons producer in sub-Saharan Africa. Most of Congo Brazzaville’s hydrocarbons production is located offshore. Congo Brazzaville holds sizable proved natural gas reserves, but only a small portion of the reserves is commercialized because of a lack of natural gas infrastructure.

Congo Brazzaville exports most of its crude oil production, and revenues from crude oil exports play a large role in its economy, making its economy vulnerable to crude oil price volatility. In June 2018, Congo Brazzaville joined OPEC as a full member and is one of the six African nations in the organization.1

Petroleum and Other Liquids

Congo Brazzaville held an estimated 1.8 billion barrels of proved crude oil reserves at the beginning of 2024, unchanged from the previous year. 2

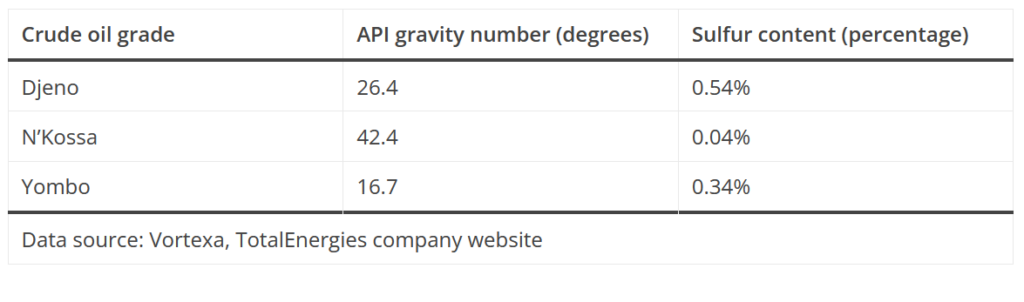

Crude oil accounts for most of the total liquid fuels production in Congo Brazzaville; the country produces very small volumes of lease condensate and natural gas liquids. Congo Brazzaville produces and exports three main blends of crude oil: Djeno, N’Kossa, and Yombo. The Djeno blend is a medium, sweet crude oil blend and is the primary blend produced and exported from Congo Brazzaville. N’Kossa is a very light, sweet crude oil blend produced in small volumes and is a blend of N’Kossa and Kitina crude oils. The Yombo blend is a heavy, sweet crude oil blend with a high viscosity level. Yombo’s crude oil properties are well suited for blending, and it is exported in small volumes primarily to destinations in the Asia-Pacific region, such as the Singapore-Malaysia fuel oil blending and storage hubs.3

Congo Brazzaville produced an average of about 273,000 barrels per day (b/d) of total liquid fuels from 2014 to 2023. Total liquid fuels production in Congo Brazzaville reversed its declining trend in the mid-2010s after a number of offshore fields in the N’Kossa Marine area were brought on line, enabling production to reach a decade-high of 347,000 b/d in 2018. Despite this recent growth, we expect the country’s total liquid fuels production to decline as a result of overall field maturation and a slowdown in upstream development. The Congolese government wants to attract new investment in upstream development by making changes to its legal and regulatory framework, but these efforts are likely to be insufficient in attracting investor interest and reviving the country’s liquid fuels production in the short term.4

Rising production from Congo Brazzaville’s offshore fields drove significant increases in total liquid fuels production in the latter half of the 2010s. The Moho Bilondo Phase 1b project in the northern part of the Moho Bilondo permit area began producing in 2015. The Moho Nord extension in the northern part of the same area started producing in 2017. TotalEnergies operates both developments. The Nene Marine offshore development in the Marine XII block and operated by Eni began producing in 2015. The Chevron-operated Lianzi offshore area is in a unitized offshore zone on the Congolese and Angolan boundaries. The Lianzi project is the country’s first cross-border development and the first in Central Africa.5

Congo Brazzaville has one operational refinery, the La Congolaise de Raffinage (CORAF) plant, in Pointe-Noire. The CORAF refinery has a nameplate capacity of 21,000 b/d, according to the Oil & Gas Journal. The Congolese government signed an agreement with Beijing Fortune Dingsheng Investment Company Limited to build a 110,000-b/d refinery in two phases at Pointe-Noire to meet increasing petroleum product demand in Congo Brazzaville and in the Central African subregion. The plant is reportedly still under construction and, according to Offshore Technology, is scheduled to begin operations in 2024.6

Natural Gas

Congo Brazzaville held an estimated 10 trillion cubic feet (Tcf) of proved natural gas reserves at the beginning of 2024, unchanged from the previous year.7

Dry natural gas production averaged about 28 billion cubic feet (Bcf) between 2013 and 2022. Congo Brazzaville uses all the natural gas it produces for domestic consumption .8

Congo Brazzaville has not yet developed sufficient natural gas infrastructure for commercial export. So, a significant amount of Congo Brazzaville’s natural gas that is produced is flared (or burned off) as a by-product of oil production or is reinjected into oil fields to aid crude oil recovery. According to the World Bank Group, Congo Brazzaville flared about 64 Bcf in 2022, accounting for significant volumes of Congo Brazzaville’s production but far below the volumes flared by the top five flaring countries (Russia, Iraq, Iran, Algeria, and Venezuela) for that year.9

Coal

Congo Brazzaville does not hold any coal reserves and so neither produces nor consumes any coal.

Electricity

Total electricity capacity in Congo Brazzaville showed a modest increase of about 0.3 gigawatts (GW) from 2013 to 2022, with most of the increase coming from fossil fuel-derived sources. Congo Brazzaville also had marginal growth in renewable sources such as solar. Electricity capacity derived from hydropower remained stable over the 10-year period.10

The World Bank estimated that only 50% of the Congolese population had access to electricity in 2021, which is an increase of 10% from 2010. Access to electricity varies significantly between urban and rural populations. Access to electricity for urban populations in 2021 was 67%, up from 57% in 2010, while access for rural populations was 12% in the same year, a 1% increase from 2010. Providing reliable access to electricity for rural populations is a significant challenge because of underdeveloped infrastructure in the electric power sector.11

Much of the growth in electricity capacity has come from natural gas projects. Installed capacity increased because of the construction of the Centrale Électrique du Djėno (CED) and Centrale Électrique du Congo (CEC) power plants in 2007 and 2010, respectively, and the capacity expansions that followed in subsequent years. Eni, the leading natural gas producer in Congo Brazzaville, constructed the two natural gas-fired power plants to reduce natural gas flaring and commercialize more of the associated natural gas produced at its oil fields. Eni also upgraded the connecting power transmission and distribution network to provide electricity access to the densely populated Pointe-Noire area. Both plants are fueled by associated natural gas from the M’Boundi and Marine XII fields.12

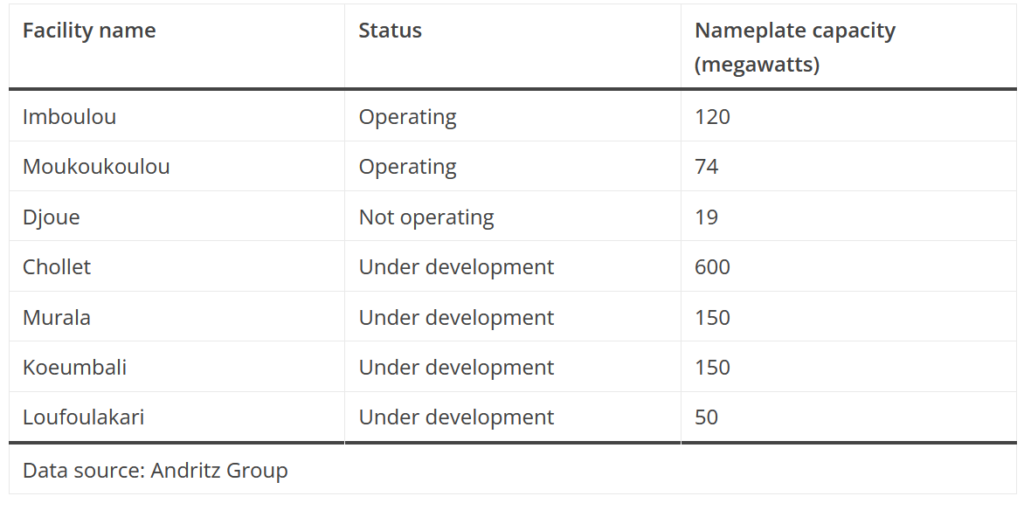

Hydropower accounted for 25% Congo Brazzaville’s total installed electricity capacity in 2021. As of early 2024, the country had three hydropower plants. Congo Brazzaville has significant hydropower potential, estimated at 3.9 GW, but only 5% of this power has been developed. Several hydropower projects are reportedly under consideration for development. The status of projects is unknown, and the projects appear to still be in early stages of development or deliberation.13

Energy Trade

Congo Brazzaville exports most of the crude oil it produces and keeps a small amount for its refinery for domestic consumption; the country does not import any crude oil. Congo Brazzaville exported an average of 252,000 b/d over the past decade .14

In 2023, Congo Brazzaville exported about 242,000 b/d of crude oil and condensate, and about 75% of total exports went to the Asia-Pacific region. China was by far the top-importing country by volume, taking about 158,000 b/d of Congo Brazzaville’s crude oil in 2023. India was the second-largest importer from the Asia-Pacific region by volume, taking about 13,000 b/d of imported crude oil from Congo Brazzaville. Europe and the Western Hemisphere (which is made up of North America, Central America, and South America as well as the Caribbean) as a region imported only 38,000 b/d and 22,000 b/d, respectively.15

Congo Brazzaville imports and exports several different petroleum products. According to estimates of seaborne trade flows of petroleum products by Vortexa, Congo Brazzaville exported an average of about 8,000 b/d of petroleum products from 2020 to 2023, primarily naphtha, liquefied petroleum gases (LPG), and fuel oil. Congo Brazzaville imported about 4,000 b/d of petroleum products over the same time, and more than 70% of these imports were gasoline and diesel/gasoil.16

Congo Brazzaville does not export or import any natural gas; all of its dry natural gas production is consumed domestically, flared, or reinjected back into wells to enhance oil recovery.

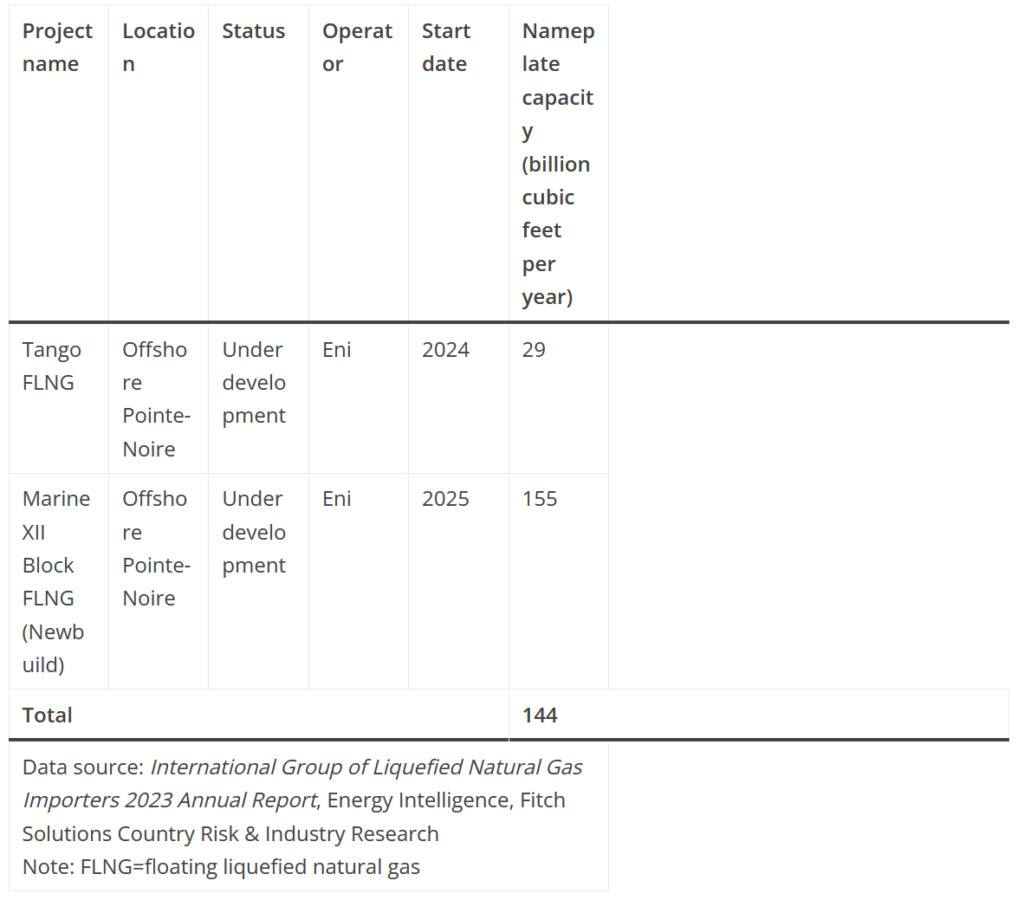

A liquefied natural gas (LNG) project is under development as of March 2024, which would enable the country to begin exporting natural gas not used for domestic consumption as well as monetize natural gas that would normally be flared or reinjected. The project is made up of two separate floating LNG (FLNG) facilities to be located offshore in the Marine XII block, from which it will source its natural gas feedstock. The first facility, the Tango FLNG facility, is a fast-tracked project with a production capacity of 29 Bcf per year and is scheduled to begin operations by the end of 2024. The second, larger facility has a production capacity of about 115 Bcf per year and is currently under construction, but it is not scheduled to begin operations until 2025.17

Endnotes

Organization of the Petroleum Exporting Countries. Congo Facts and Figures, accessed February 23, 2024.

“Worldwide Look at Reserves and Production,“ Oil & Gas Journal, Worldwide Report [Table], December 4, 2023.

“IMO 2020: Focus on Yombo Crude,“ Vortexa, August 8, 2019. “N’Kossa Blend data sheet,“ TotalEnergies company website, August 25, 2017. “Djeno Blend data sheet,“ TotalEnergies company website, January 30, 2018. “Crude oils have different quality characteristics,“ Today in Energy, U.S. Energy Information Administration, July 16, 2012.

U.S. Energy Information Administration, International Energy Statistics database, accessed February 5, 2024. “Congo Licensing Round 2016,“ The Energy Year, January 9, 2017. Robert Perkins, ed. Richard Rubin, “Congo set for output slide without new discoveries and developments,“ Rystad Energy, September 10, 2020.

“Chevron Confirms First Production From the Moho Bilondo Phase 1b Development Offshore the Republic of Congo,“ Chevron company press release, December 11, 2015. “Moho Nord: an Industrial and Human Challenge in the Republic of the Congo,“ TotalEnergies company website, accessed February 23, 2024. “Total starts up Moho Nord offshore Congo,“ Offshore-mag.com, March 15, 2017. “Chevron Announces First Production From The Lianzi Development Offshore the Republic of Congo and Angola,“ Chevron company press release, November 2, 2015. “Eni starts production at Nené Marine Field, offshore Congo,“ Eni company press release, January 5, 2015. “Congo Brazzaville Oil & Gas Report Q1 2024,“ Fitch Solutions Country Risk & Industry Research, October 2023. Rystad Energy, “Nene Marine, Congo,“ Upstream Asset Report, February 2024.

“2022 Worldwide Refining Survey: Global,“ Oil & Gas Journal, Worldwide Report [Table], January 2023. “Construction of a New Refinery in Pointe-Noire,“ press release, Republic of Congo Ministry of Finance, November 24, 2020. “Republic of Congo building $600-million refinery,“ The Energy Year, February 24, 2021. “Refinery profile: Pointe Noire II cracking refinery, Congo Republic,“ Offshore Technology, November 15, 2023. Elza Turner, ed. Daniel Lalor, “Refinery News Roundup: Upgrades in Africa,“ S&P Global Platts, July 13, 2022.

“Worldwide Look at Reserves and Production,“ Oil & Gas Journal, Worldwide Report [Table], December 4, 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed February 5, 2024.

The World Bank Group, “Global Gas Flaring Data,“ Global Gas Flaring Reduction Partnership, accessed February 13, 2024. The World Bank Group, “Global Gas Flaring Tracker Report,“ Global Gas Flaring Reduction Partnership, March 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed February 5, 2024. “Dubai’s Renewables Capacity Pushes Past 1.5GW,“ Middle East Economic Survey, Vol. 65, Issue 03, January 21, 2022.

World Bank Group, World Bank Open Data Portal, accessed February 13, 2024. Atlas of Africa Energy Resources, United Nations Environment Programme, 2017, pg. 244.

“The Integrated energy access project in Congo,“ Eni company website, accessed February 13, 2024.

U.S. Energy Information Administration, International Energy Statistics database, accessed February 5, 2024. Atlas of Africa Energy Resources, United Nations Environment Programme, 2017, pg. 242. Manuel Tricard, “Republic of Congo – Moving forward with hydropower,“ Andritz Group, accessed February 13, 2024.

U.S. Energy Information Administration, International Energy Statistics database, accessed February 5, 2024.

Vortexa trade flows database, accessed February 5, 2024

Vortexa trade flows database, accessed February 5, 2024.

International Group of Liquefied Natural Gas Importers (GIIGNL), 2023 GIIGNL Annual Report, July 20, 2023. Daniel Steimler, ed. Jaime Concha, “New LNG Supply Additions Ease Tightness Out to 2025,“ Energy Intelligence, February 20, 2024. “Congo Brazzaville Oil & Gas Report Q1 2024,“ Fitch Solutions Country Risk & Industry Research, October 2023.