Introduction

The countries of the central Maghreb – Algeria, Morocco, and Tunisia – are increasingly difficult partners for Europe. Over the past few years, their leaders have become more assertive in trying to set the terms of relations with the European Union and its member states, using both their countries’ strengths and vulnerabilities to win concessions. They have turned energy assets, the threat of migration, and even the risk of economic collapse into tools to secure diplomatic goals, deflect international criticism, and extract financial support without burdensome conditions. Instead of standing together in the face of these moves, European countries have presented a fragmented response.

Following the 2011 pro-democratic uprisings across the Arab world, the EU and its member states coalesced around a policy of backing reform and supporting transitions. But after 2015, a surge in migration and rising concern about terrorism – both issues that played strongly in European domestic politics – led to a more transactional approach. More recently, the war in Ukraine and the need to fight climate change have prompted Europeans to focus on both gas supplies and renewable energy. EU member states have thus gravitated towards enhancing relations with those Maghreb countries that serve their national interests. At the same time, tensions between the two most powerful Maghreb countries – Morocco and Algeria – have increased sharply, making it more difficult for European countries to maintain close ties with both.

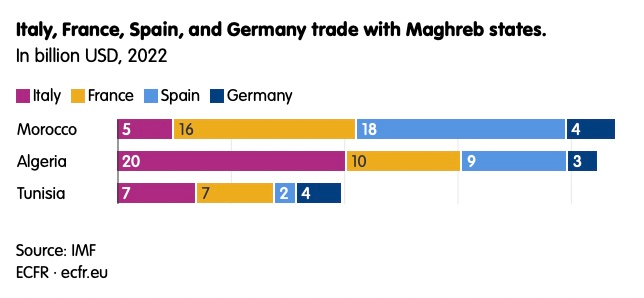

Against this background, the policies of the most influential EU member states in the region – Italy, France, Spain, and Germany – are diverging, shaped by the different concerns and priorities of each country. Migration concerns mean Italy has pushed an ‘engagement-first’ strategy with Tunisia, prioritising dialogue with President Kais Saied over criticism of his turn against democracy. It has also boosted energy links with Algeria. France was traditionally the leader on European Maghreb policy, but tensions with Morocco and Algeria have limited its influence in the region. Spain has doubled down on its close relations with Morocco, provoking a diplomatic break with Algeria. Germany became influential in Tunisia particularly as a supporter of reform after 2011, but has now stepped back and focuses largely on renewable energy investments in the region.

This policy brief maps the new landscape of European policy towards the Maghreb, by examining the sources and objectives of the policies of the four most influential member states. National relationships have always shaped European policies towards the Maghreb: Italy, France, and Spain have close ties to countries in the region, based on history, diaspora populations, commercial links, and security cooperation, while Germany’s newer interest in reform and the green transition have underpinned its engagement. But, as the choices facing Europeans in the Maghreb have become more acute, and as Algeria and Morocco have embraced a zero-sum logic in which any move to deepen relations with one is treated as a snub by the other, national interests have become particularly influential and European policy less coordinated.

Europe weakens itself in its relations with the Maghreb by pursuing this fragmented approach. It is inevitable that EU member states have their own interests to pursue, but if they framed them within a broader European vision, it would give them an advantage. The current approach risks allowing North African leaders to claim the upper hand in bilateral, interest-driven relations. But France’s, Italy’s, Spain’s, and Germany’s varying relationships with Maghreb countries could become a source of strength for Europe if they were more effectively harmonised. This would help them achieve a set of goals they broadly share: to encourage better economic policymaking and governance in Tunisia, to foster progress towards greater openness in Algeria, and to deepen cooperation with Morocco while resisting diplomatic pressure over the disputed territory of Western Sahara. This policy brief thus sets out how a better balance between bilateral ties and European coordination would be the most effective foundation for the EU to achieve its long-term goals in the region.

Developments in the Maghreb

In the Maghreb, the last five years have been marked by democratic backsliding, economic strains, and growing intra-regional tensions, as well as by a sense of empowerment in the three states’ dealings with Europe. Europeans need to view the evolution of member states’ policies towards the region against this backdrop.

Tunisia

In July 2021, Saied suspended Tunisia’s parliament and seized essentially unlimited power, ending an era of democratisation in the country. Since 2011, Tunisia had seen a series of competitive elections and a blossoming of civil society and press freedom. But successive governments made little progress in tackling the country’s significant economic and social inequalities. This fomented popular frustration with the political class and helped Saied, a university lecturer in constitutional law who ran on a populist anti-corruption platform, to win the presidential election in 2019. His move to seize unchecked power 20 months later prompted large demonstrations – but his programme of centralising power has seemingly been met with increasing public indifference.

Saied initially ruled by decree, but in July 2022 he pushed through a hastily drafted new constitution that redrew Tunisia’s post-revolutionary political settlement. Expert in constitutional law, Zaid al-Ali, has described the new system as “hyperpresidential”, with the executive enjoying virtually unchecked power. The country’s parliament has been reduced to a rubber stamp; its judiciary is no longer independent. Saied has also locked up several of his most prominent political opponents, as well as journalists, lawyers, and trade union officials, accusing them of plotting against state security. He has combined these repressive moves with xenophobic rhetoric and a sovereigntist nationalism.

As Saied focused on consolidating his power, Tunisia’s economy continued to deteriorate. Following years of slow growth and deferred economic reforms, the impact of the covid-19 pandemic and increases in commodity prices triggered by Russia’s war on Ukraine brought on a balance of payments crisis. The private sector is constrained from large-scale job creation by entry barriers and a high cost of doing business, meaning state employment has acted as a safety valve to limit public hardship. But the country’s debts have mounted: public debt stands at 77 per cent of GDP and debt service payments of $2.6 billion are due in 2024, a sum that outstrips the public sector wage bill for the first time. The International Monetary Fund (IMF) and Tunisian officials reached a staff-level agreement for a $1.9 billion deal in 2022, but Saied declined to move forward with this. He said Tunisia will not submit to “diktats that come from abroad”, sacking his finance minister after the latter argued that an IMF deal would make it easier to obtain other financing.

The last few months of 2023 saw Tunisia’s financial situation improve slightly, thanks to an increase in tourism revenues and remittances from workers abroad. Nevertheless, without an IMF deal, Tunisia faces a very challenging year. The budget for 2024 relies on obtaining substantial new financing from overseas, including €470m from Saudi Arabia, €286m from Algeria, and around €3 billion from unspecified sources. Tunisia’s finance minister claims the money will come from the country’s “relations with sisterly and friendly countries”.

Last year also saw a sharp increase in the numbers of irregular migrants crossing from Tunisia to Europe, with almost all of them arriving in Italy. More than 150,000 people arrived in Italy via the central Mediterranean route in 2023, compared to 105,000 in 2022. More than 97,000 of these are thought to have departed from Tunisia, and almost all of the rest from Libya. Many of these migrants had transited through Tunisia from sub-Saharan Africa – particularly Côte d’Ivoire and Guinea. But since 2020 significant numbers of Tunisians have also been travelling to Italy.

In response both to Tunisia’s economic problems and the increase in migration, the EU concluded a memorandum of understanding with Tunisia in July 2023. The agreement wrapped together some EU funding that had already been allocated to Tunisia for border management with further budget support. This was supplemented by the promise of an additional €900m in macro-financial support to be delivered following the signing of an IMF deal. The agreement also outlined a broader agenda for cooperation, covering people-to-people exchanges, economic development, investment and trade, renewable energy, and migration.

But the deal was controversial in Europe. Its announcement coincidedwith revelations that Tunisian security forces had taken large groups of sub-Saharan migrants to desert regions on the country’s borders and expelled them without food or water – a practice Tunisia has continued. And in October 2023, Saied announced he would reject a €60m payment from the EU, arguing it was too small and failed to show the “respect” that should be the foundation of the partnership.

Algeria

Algeria has benefited from Russia’s war in Ukraine. The spike in oil and gas prices and European countries’ search for alternative suppliers to replace Russian gas resulted in a boon for Algeria’s leaders, allowing them to reinforce a social contract that uses hydrocarbon revenues to buy off public discontent. The country posted a $19 billion current account surplus (9.8 per cent of GDP) in 2022. And, though gas prices fell in 2023, Algeria still enjoyed a current account surplus of $2.9 billion for the first half of that year. The country’s budget for 2024 lays out how this surplus is being used to bring down the escalating cost of living, including through a big rise in public wages and spending on housebuilding. Algerian gas, delivered both through pipelines and in the form of liquefied natural gas, played an important role in allowing the EU to reach its target of filling gas storage facilities to 90 per cent of capacity ahead of a November 2023 deadline. Algerian gas exports to the European Union rose from 41.8 billion cubic metres (bcm) in 2021 to 55.2 bcm in 2022.

The economic benefit of the oil and gas boom has allowed Algeria’s president, Abdelmadjid Tebboune, to consolidate his regime’s position at home. This followed the massive anti-elite ‘Hirak’ protests in 2019 that drove the country’s longstanding leader, Abdelaziz Bouteflika, from office. But Tebboune’s election in December 2019 represented a reassertion of the power of the country’s ruling class, an opaque network of the military and economic elites, rather than the change of political system the protesters were calling for. Protests were nevertheless suspended in 2020 due to the covid-19 pandemic; Tebboune has prevented any resurgence through a combination of public spending and increased repression. Authorities have cracked down on opposition activists and critical voices, subjecting them to repeated judicial harassment and arrest. Activists estimate that more than 200 peoplehave been imprisoned for political activity, including such high-profile figures as the journalists Ihsane El Kadi and Mustapha Bendjemaa.

Yet, Algeria’s economic future remains precarious. The country’s gas industry continues to suffer from poor infrastructure and the limited capacity of the gas fields that are now in use. In an Autumn 2023 updateon Algeria, the World Bank argued that “continued reforms to foster private sector investment, growth and diversification are needed [to] improve the performance and resilience of the economy”. But these reforms are proceeding (at best) slowly, as Tebboune tries to build his public support and reinforce his position with the oil- and gas-affiliatedarmy and political establishment ahead of elections next year. The government has repeatedly postponed planned reforms to reduce fuel subsidies and improve the functioning of the tax system. Despite Algeria’s potential to generate renewable energy, including green hydrogen, the regime has been hesitant to take decisive steps towards this transition.

Tebboune has also embraced a more assertive foreign policy, designed to boost Algeria’s regional and international profile and to improve his public standing. This has included a forceful response to what Algerian officials describe as a “series of provocations” from Morocco, leading to a sharp increase in tensions between the two leading Maghreb countries in recent years. Their rivalry centres on the disputed territory of Western Sahara, which Morocco claims (and has largely occupied), but where Algeria supports the right to self-determination of the local Sahrawi people and the Polisario Front movement that represents them.

Algeria cut diplomatic ties with Morocco in September 2021. It did this not only in response to Moroccan military action in Western Sahara, but also to the country’s alliance with Israel and some Moroccan officials’ statements in support of separatist movements in Algeria. While the dispute has not escalated into any direct military confrontation between the two countries, it has led them to adopt a zero-sum logic in their relations with third countries.

Morocco

Morocco now treats Western Sahara as “the prism through which [it] views its international environment”, as King Mohammed VI said in a speech in 2022. He added that the issue was the “clear and simple measure for the sincerity of friendships” between Morocco and its international partners. The country has engaged in an escalating diplomatic offensive to win international recognition for its claims on the territory in recent years. These efforts received a huge boost when US president Donald Trump agreed to recognise Western Sahara as part of Morocco in December 2020, in exchange for Morocco normalising relations with Israel. The Biden administration has not reversed that decision, though it has also not moved forward with any action to build on it, such as opening a consulate in the territory; US officials have avoided repeating Trump’s statement.

While EU member states have expressed different views on the most desirable outcome in Western Sahara, they subscribe to a common position of support for the UN-backed process to achieve “a just, lasting and mutually acceptable political solution”. However, the EU has repeatedly been forced by its own courts to make clear that it does not regard Western Sahara as Moroccan territory, and that Morocco cannot lawfully enter into agreements that include the territory without the genuine consent of the Sahrawi people. In the most recent decision, issued in September 2021, the General Court of the European Union determined that agreements between the EU and Morocco on trade and fisheries did not extend to Western Sahara. The European Commission and Council have appealed the decision and the court will likely rule on the appeal in the first half of 2024.

After earlier court rulings, the EU worked with Morocco to revise the agreements in question. However, if the European Court of Justice (ECJ) upholds the General Court’s decision, it would seemingly exhaust the options available to include Western Sahara in the agreements. This would provoke a major crisis in relations between Morocco and the EU. Indeed, Morocco briefly suspended ties with the EU after an earlier European court decision in 2016. The king has said that Morocco will never agree to any economic or commercial initiative that excludes Western Sahara – though since 56 per cent of Moroccan exports go to the EU, it would likely be prohibitively costly for the country to follow through on this threat.

The reluctance of the EU to provoke a crisis with Morocco testifies to the country’s diplomatic skill in making itself an effective partner for Europe. Apart from its close ties to Spain and France (discussed below), Morocco has gone further than its neighbours to diversify its economy, attract European investment, and embrace renewable energy. Morocco signed a green energy partnership with the EU in October 2022, the first between the EU and any partner, and one intended to act as a template for future agreements. The partnership aims to strengthen policy coordination and foster green projects. Morocco is already home to one of the world’s largest concentrated solar power plants.

Despite its economic progress, Morocco still faces problems in deepening and spreading the benefits of growth across its society. The IMF summarised these difficulties in October 2023 as “a high share of inactive youth, large gaps in economic opportunities for women, a fragmented social protection system, and remaining barriers to private sector development”. Moroccan leaders have set out a plan to tackle these shortfalls through a new development model that was announced in 2021. The country also maintains tight control over freedom of speech, using prosecution on questionable charges and other forms of intimidation to try to close down critical voices. Finally, Moroccan relations with some European institutions have been strained by allegations that the country deployed Pegasus spyware to monitor the communications of European targets and ran a bribery campaign in the European Parliament.

These developments in the Maghreb countries interact with the concerns and drivers of policy in the four most influential EU member states to foster European divergence.

Italy: A newfound leader on Mediterranean policy

It is somewhat unusual for Italy to take an active role in trying to shape European foreign policy. Over 2023, however, its government made a determined effort to set the EU’s policy towards Tunisia. Italian leaders have pushed for a policy of pragmatic engagement focused on migration and the economy. The memorandum of understanding that European Commission president Ursula von der Leyen signed with Saied in July 2023 resulted from an Italian initiative. Indeed, Italian prime minister Giorgia Meloni has prioritised building ties with Saied: in June 2023 she travelled to Tunisia twice within a week, the second time alongside von der Leyen and Dutch prime minister Mark Rutte. The same three leaders returned to Tunisia for the signing of the memorandum.

According to Italian analysts, the initiative was not the result of strategic planning, but rather an improvised response to a crisis.[1] The arrival in Italy of 27,000 migrants in March and April 2023 – more than five times the number that had arrived in those months the year before – created an urgent need to be seen to act. Italian officials describe migration from Tunisia as an issue that could have a direct impact on Italian national security. On top of this, Meloni was faced with the public failure of one of her signature policies – to curb migration. Her need for a symbolic demonstration that she was taking decisive action to address migration from Tunisia accounts for the peculiar nature of the memorandum, which did not contain any new and binding commitments. The symbolism of an enhanced partnership was for both parties the main benefit of the agreement.

The ambiguous nature of the memorandum has apparently given rise to some disappointment on the Tunisian side. Saied implied this, for example, in his claim that the sums the commission was releasing were too small. But the Italian government has continued to push for the EU to move forward with the document’s agenda. Italian officials recognise that Saied is a complicated partner, but they argue that the best way to work with him is by winning his trust and putting forward a package that demonstrates Europeans are listening to his concerns, including about domestic stability in Tunisia. They see no alternative to working with Saied, as he is the only person who counts in Tunisian politics and remains the least unpopular political figure in the country. Italian officials contend that engagement with Saied may give them a small opening to moderate his authoritarian drift – but it is clear that they will persist in their approach to Saied even if this does not happen. Some officials believe that Meloni and Saied have a good understanding: as Saied said to Meloni when she visited Tunis, “You are a woman who says out loud what others think in silence.”

The importance of the links between Italy and Tunisia gives the Italian government a strong incentive to maintain good relations. Italy overtook France as Tunisia’s leading trade partner for the first time in 2022.

Most significantly, Italian leaders fear the consequences of a further deterioration of the economic situation in Tunisia, which could result in widespread unrest and lead even more migrants to leave for Italy. As Tunisia’s economic problems deepened, Italy pushed for the IMF to adopt a “pragmatic” approach and reportedly suggested the IMF could advance funds before its agreement with Saied was confirmed. Italian officials accept for now that large-scale EU financial assistance for Tunisia remains conditional on the IMF agreement. But they want the EU to explore more creative options to continue supporting the country if the IMF deal definitively falls apart. As one official put it, Italy “has no plan B in case of an economic collapse in Tunisia, and the consequences are too dire to contemplate”.

Beyond Tunisia, the Italian government sees itself as pioneering a new model for relations with North Africa more broadly. Italy has long enjoyed good relations with Algeria, based in part on the role played by the founder of the Eni energy company, Enrico Mattei, in supporting Algerian independence. The gas pipeline that runs from Algeria through Tunisia to Italy is named after Mattei. In 2022, Italy’s then-prime minister Mario Draghi signed a series of agreements with Algeria that turned the country into Italy’s largest gas supplier, replacing Russia. Gas imports from Algeria to Italy rose from around 20 bcm in 2021 to 22.4 bcm in 2022, an increase of 12 per cent. In January 2023, Giorgia Meloni visited Algeria alongside Eni executives, and the company signed agreements with the Algerian state-owned gas company Sonatrach to cooperate on improving Algeria’s energy efficiency and export capacity, as well as to develop green energy projects.

To build on these developments, Meloni in January 2024 unveiled a broad plan for Italy-Africa cooperation on energy, migration, and development, also named after Mattei. The much-trailed “Mattei plan” centres on a vision of a “cooperation on an equal basis” that fits well with Italy’s ‘engagement-first’ approach. It also has a strong migration rationale: for example, Meloni set out in a speech at the United Nations that the Mattei plan would provide “a serious alternative to the phenomenon of mass migration, made up of work, training, opportunities in the countries of origin, and legal and agreed migration paths”.

As my ECFR colleagues Lorena Stella Martini and Tarek Megerisi have written, Meloni seems to be trying to balance her short-term need to stem migration with a longer-term vision of migration management through development. The plan’s priorities will include education and training, health and agriculture, and water and energy. Much of the investment envisaged in the Mattei plan serves Meloni’s ambition to establish Italy as an energy hub for supplies from Africa to Europe, with a focus both on gas and on green electricity and hydrogen. Yet, Italy will need European backing for the plan to succeed. Meloni revealed that the initial funding allocation will be around €5.5 billion – an amount that will only make a real difference if it is harmonised with broader European policy.

Algeria and Tunisia thus occupy a central place in Italian policy. But Italy has also maintained ties with Morocco and considers the country a strategic partner. Italian industry has made significant investments in Morocco, particularly in the country’s automotive value chain. Italy’s relationships with both Algeria and Morocco endure perhaps because the latter does not consider Italy a close enough partner to press on the matter of Western Sahara. Nevertheless, Italy would likely oppose any steps that could jeopardise its relations with Algeria, such as a European attempt to evade a legal obligation to differentiate between goods from Morocco and Western Sahara, if the ECJ rules against Morocco later this year.

France: The burden of expectations

As the former colonial power in Tunisia, Algeria, and large parts of Morocco, France has a legacy of deep economic, social, and cultural ties in the Maghreb. Indeed, no other country in Europe can match the density of French ties across the three countries. The bulk of the Algerian and Tunisian diasporas in Europe are based in France, as well as a significant part of Morocco’s. In 2021-22, more than 46,000Moroccans were studying in France, accounting for the largest group of foreign students in the country; 31,302 Algerian students accounted for the second largest group. Moreover, 51,000 French nationals lived in Morocco in 2023, rising to twice that number if dual nationals are included.

These ties have not translated into easy political relationships in recent years. Because its ties and interests extend across the central Maghreb, France has no alternative but to pursue an approach that balances relations with all three countries. For that reason, it has traditionally favoured formats that integrate the countries of the Maghreb in larger organisations, such as the Union for the Mediterranean. But the strength of France’s interconnections and historical relationships also means that it is the object of high expectations and demands from the countries of the Maghreb. These have become more difficult to manage as intra-regional tensions rise. Moreover, the persistence of nationalist sensitivity in Algeria and the sovereigntist ideology of Kais Saied in Tunisia pose a challenge for France in light of its past colonial role.

French relations with Morocco in particular have undergone a period of turbulence in recent years. One reason for this is France’s position on Western Sahara. After Trump changed the US position on the territory, France crystallised as the next prize for Morocco to chase in its campaign to entrench its claim to sovereignty. France has long been one of the strongest European supporters of Morocco’s proposed solution for its dispute with the Sahrawis, which would see Western Sahara as an autonomous region under Moroccan sovereignty. French leaders have consistently described this plan as “a serious and credible basis” for resolving the dispute. But this choice of words, which once appeared to tilt towards Morocco, now looks weak in comparison to the positions of the US and, as discussed below, Spain. As a result, Morocco has mounted a sustained pressure campaign: as one French official said, “Morocco wants more because of what Trump did.”[2]

But Western Sahara is not the only source of tension. In September 2021, France announced that it would cut back on all types of visas for all three central Maghreb countries – setting a refusal rate of 50 per cent for applications from Morocco and Algeria, and 30 per cent for Tunisia. The measure was a response to an alleged lack of cooperation from these countries in accepting the return of irregular migrants from France. The move aroused particular resentment in Morocco, whose elites are accustomed to travelling regularly between the two countries. After the outcry it provoked, France abandoned the restriction for all three countries in December 2022 – a move first unveiled by the French foreign minister, Catherine Colonna, in Rabat.

Another irritant was an initiative launched by President Emmanuel Macron to improve French relations with Algeria. Macron entered office in 2017 having committed to address France’s colonial legacy more directly than previous governments. And the following year he became the first French leader to formally acknowledge France’s use of torture during the Algerian war of independence. But the president then antagonised Algerians in 2021 by commenting that the country’s “politico-military system” lived off the history of the colonial war as a “memorial rent” to legitimise its rule. To repair ties, Macron conducteda high-profile visit in August 2022.

However, Macron’s attempt to deepen France’s partnership with Algeria was costly for relations with Morocco, as French officials acknowledge. French attitudes to Morocco were also affected by revelations of Morocco’s extensive spying programme, which reportedly targetedMacron’s phone for hacking. But there are signs that France’s relations with Morocco are improving. In October 2023, Morocco named a new ambassador to France, filling a post that had remained unoccupied since the beginning of the year. King Mohammed VI also accepted the credentials of France’s ambassador to Morocco, nearly a year after his appointment.

Meanwhile, Macron’s initiative to improve relations with Algeria is advancing at best slowly. His attempt to reset relations was not only motivated by interest in Algeria’s extensive gas reserves, officials say, but also by a political goal of finally moving past the legacy of the war of independence. However, officials believe that, while Macron has established good relations with Tebboune, he may initially have overestimated the Algerian president’s room for manoeuvre within the closed system of the Algerian regime.

One of the central initiatives was a joint commission of Algerian and French historians as part of Macron’s efforts to confront the colonial era that has now held three meetings, though progress on access to archives has been sporadic and inconsistent. Any hope of better cooperation between France and Algeria on security in the Sahel has been hampered by the fact that both countries have experienced diplomatic setbacks in the region. This is most obvious in the case of France, whose forces were asked to withdraw by military governments in Mali, Burkina Faso, and Niger; but Algeria too has lost influence as the negotiation processes it sponsored, notably the 2015 Algiers Peace Agreement for Mali, have been derailed by coups. French politician, Frédéric Petit, published a critical report on Franco-Algerian relations in autumn 2023, arguing that state-to-state bilateral relations remained essentially blocked, and that France should concentrate on a non-governmental diplomacy that increased links between French and Algerian societies. Nevertheless, officials say that Macron is committed to the project of improving official ties, and that the Algerian regime may continue to evolve towards greater flexibility in the next few years.

French policy on Tunisia is still taking shape. Like Italy, it has a strong interest in the stability and economic health of the country: over 1,000 French businesses operate in Tunisia, employing between 140,000 and 150,000 people. France also wants to limit migration, as many Tunisian migrants make their way through Italy to France. French ministers have clashed with their Italian counterparts over whether Italy is allowing some of these migrants to pass through the country without being registered. To ease tensions, officials say Macron is disposed to support Meloni’s efforts to reinforce Tunisia’s border security and bolster the country’s finances. But internal debates continue within the French system over how far it is possible and desirable to work with Saied on migration, and how much economic support Europe should give Tunisia if the IMF agreement is not finalised.

Spain: A tilt towards Morocco

In March 2022, the Moroccan palace revealed that the king had received a private letter from Spain’s prime minister, Pedro Sánchez, in which he described Morocco’s autonomy plan for Western Sahara as “the most serious, realistic and credible” basis for resolving the conflict. This marked a clear step by Spain towards Morocco’s position. It also went beyond anything French leaders or those of any other European country had said by elevating the Moroccan plan above other possible solutions. Spain’s change of position was an attempt to repair relations with Morocco following a prolonged dispute between the countries that began after Madrid allowed the leader of the Polisario Front, Brahim Ghali, to receive medical treatment in Spain. By taking this step, Sanchez showed he was willing to prioritise relations with Morocco above a more comprehensive vision of policy towards the Maghreb.

Spain’s relationship with Morocco has always been of crucial importance. Two semi-autonomous Spanish cities, Ceuta and Melilla, lie inside Morocco; their boundaries are the only land borders between Europe and Africa. Just 14 kilometres separate the main territories of Spain and Morocco across the Strait of Gibraltar. Since the 2004 train bombings in Madrid, carried out by a group of predominantly Moroccan immigrants, Spanish authorities have viewed cooperation with Moroccan intelligence services as vital to Spain’s security.

Nevertheless, after joining the European Community in 1986, Spain had tried to situate its policy towards Morocco within a larger framework of European policy towards the Maghreb. As the historian Miguel Hernando de Larramendi has argued, Spain hoped that, by Europeanising its relations with the Maghreb in the 1980s and 1990s, it could secure European resources to help promote stability and prosperity in the region, as well as encourage integration. Hopes for regional integration dissipated thanks to tensions between Maghreb countries, but Spain benefited from putting the contentious issues of trade and fisheries into a European framework. Alongside this, Spain pursued bilateral relations with both Morocco and Algeria, signing treaties of friendship with both countries. Spain established itself as Morocco’s leading trade partner, with commerce increasing at an average of 10 per cent each year since the turn of the century. Meanwhile, Algeria has been Spain’s leading supplier of natural gas, providing 40 per cent of Spain’s needs in 2021, mostly through the Medgaz pipeline that directly links the two countries.

Moroccan pressure on Spain had been growing even before March 2022. While the decision to treat Ghali was the immediate cause of the breakdown in relations the previous year, it came against the backdrop of increasing Moroccan demands for a revision of Spain’s Western Sahara policy. The consequence was a surge of 8,000 migrantsattempting to enter Ceuta and Melilla over two days in May 2021, with Moroccan police doing nothing to stop them. Spanish officials complained that this was an act of blackmail by Morocco. Even so, the incident seems to have played a part in ultimately persuading Spain that it needed to restore relations, leading to the change in position. Spanish officials also say Spain was conscious that in a new geopolitical context, Morocco had other options for alliances, weakening Spanish leverage.[3]

Spanish officials defend the shift on Western Sahara as a gesture that does not alter their fundamental commitment to the UN negotiation process. They also say it has allowed Spanish relations with Morocco to advance to a new level. In April 2022, Sánchez and King Mohammed VI signed a declaration of principles that laid out a roadmap for future actions, including the launch or restarting of a series of working groups covering all the main areas of mutual concern, such as migration, the definition of maritime boundaries, trade, education, science, and culture. Moreover, they agreed to work towards full normalisation of trade between Morocco and Ceuta and Melilla: Ceuta has never had a customs post, while the customs post for Melilla was closed by Morocco in 2018.

Officials say the working atmosphere and trust between the two sides are much improved. But there have been few tangible results to date. On customs, Morocco’s foreign minister said recently that there was no problem of commitment or politics, but that there remained “a problem of technical implementation”. Sánchez’s letter to the king represented a concrete gain for Morocco in exchange for the promise of future benefits for Spain. The fact that Morocco announced the terms of the letter without Spain’s agreement or advance knowledge suggests that Morocco has emerged empowered from the episode.

Spain’s change of position also marked a clear end to the policy of maintaining some balance in its relations with Morocco and Algeria. Algerian leaders had not been informed of the letter – and were particularly infuriated when Spain’s foreign minister José Manuel Albares, caught out by Morocco’s revelation, suggested that they had been aware. In response, Algeria suspended its treaty of friendship with Spain and announced it was cutting off trade in almost all sectors. Algerian purchases of Spanish goods fell from €329m in June and July 2021 to €94m in June and July 2022 – and have fallen further since. In an indication of the growing renationalisation of Europe’s Maghreb policy, no other European country was informed in advance about Spain’s change of position, and none came to Spain’s defence over trade with Algeria, even though trade is a European competence. Instead, other member states, particularly France and Italy, reaped a commercial benefit by increasing exports to Algeria.

But Algeria did not cut off gas supplies to Spain. In a press release in October 2023, Sonatrach officials underlined the company’s “essential role in supplying gas to Spain and Europe in general, as a secure and reliable supplier”. However, as the dispute coincided with a scheduled contract renegotiation, it appears that the price Spain paid for gas increased significantly. At the end of 2023, there were signs that the dispute might be easing, as Algeria announced that it was naming an ambassador to Spain after an interval of 19 months. One reason may lie in the Spanish election of July 2023. Algerian officials may have been waiting to see if a new Spanish government would come into office, to replace the prime minister who they felt had betrayed them, but decided to draw a line under the dispute after the results showed that Sánchez was likely to keep his position.

Germany: From reform to renewables

Germany did not take a great interest in the Maghreb before 2011. As one official said, German governments were content to defer to the EU’s southern member states, particularly France.[4] But that changed with the Arab uprisings. German politicians and public alike were inspired by the pro-democratic movements, and the region moved to the forefront of German policymaking. Within German government and civil society, there was strong engagement in favour of supporting democratic transitions, with a central focus on Tunisia’s as the most promising. Germany established a “transformation partnership” with Tunisia as early as 2012. The GIZ development agency greatly expanded its work in the country, employing more than 500 people in Tunisia by 2022. All six German political party-affiliated foundations had offices in Tunisia after the revolution. A study of Tunisian political party views published in 2014 quoted activists as saying Germany was “very present”, “active”, and “very dynamic”; one said that Germany had been “more visionary and faster than others” in responding to the transition.

Germany’s investment in Tunisia’s democratisation meant that Saied’s counter-democratic regression has come as a bitter blow. As one German official said, the sight of tanks positioned outside the suspended parliament in Tunis damaged support for the country more in the German parliament than in France’s or Italy’s because of the high expectations that Germans had entertained. Following Russia’s invasion of Ukraine, Germany has also faced an urgent strategic threat closer to home – and the German political system has been intensely focused on that. While Italy conducted high-level shuttle diplomacy in Tunisia during 2023, few senior German officials have visited since February 2022.

As a result of these developments, Germany has maintained a policy of critical distance towards Tunisia, opposing some of the proposals advanced by other countries but offering no alternatives of its own. A letter from German foreign minister, Annalena Baerbock, to the European Commission, later reported in the press, sharply criticised the European Commission’s lack of consultation before signing the memorandum of understanding with Tunisia last July, at a time when Tunisia’s abusive treatment of migrants was under scrutiny. Parliamentarians from Baerbock’s Green Party were particularly vocal in attacking the agreement: “Democracy, human rights and the rule of law must guide us in our cooperation – something that was not given suitable consideration, in the agreement with Tunisia,” Baerbock wrote. Germany has also emerged as a leading opponent of any suggestion that additional European financial assistance should be given to Tunisia in the absence of a new IMF agreement with the country.

Disillusioned with reform in the region, Germany now looks at the Maghreb through a more transactional lens, but without the sense of urgency of France, Italy, and Spain. In the words of one German parliamentarian, the country’s position towards these other member states is like that of a disengaged parent whose children are fighting amongst themselves.[5] Germany supports a more coherent European policy but lacks the ability and commitment to bring its own interests to the table. Moreover, while the Greens remain hesitant to work too closely with Saied in Tunisia, migration from North Africa is a highly contentious issue in Germany. It has, for example, been a prominentissue in the rise in support over recent months for the far-right Alternative for Germany party. But the dominant focus for the German government in North Africa is the search for renewable energy. In August 2022, Germany and Morocco agreed to set up a strategic dialogue with climate policy as the first item on the agenda. Shortly afterwards, Germany agreed to commit €243m to cooperation with Morocco on sustainable development and climate measures, including the construction of the first green hydrogen plant in Africa.

To facilitate this cooperation, Germany had to overcome its own diplomatic crisis with Morocco. It stemmed from a German move to call a UN Security Council meeting to discuss the implications of Trump’s recognition of Moroccan sovereignty over Western Sahara, which the Moroccan foreign ministry described as “antagonistic activism”. The crisis ended after Germany issued a statement calling Morocco’s autonomy plan “serious and credible” and a good basis for a mutually agreed solution. In a kind of calibration of leverage, Morocco settled for a weaker statement from Germany than it later demanded from Spain. Nevertheless, Germany attaches significant weight to relations with Morocco, given the latter’s stability and relative openness to commercial cooperation.

Germany was able to issue its statement on Western Sahara without jeopardising its relations with Algeria, which also centre on renewable energy. German leaders look to Algeria as a key supplier of green hydrogen in particular, hoping to import this by upgrading the existing gas pipeline network in cooperation with Italy and Austria. German officials believe Algeria is ready to move forward with the project, despite some hesitation in embracing renewable energy up to now. Some policymakers and industrialists in Germany also hope to increase its weapons sales to Algeria, which may be reconsidering its reliance on Russian arms after the Russian forces’ poor performance in Ukraine. But this comes with legal complications, since Germany cannot by law sell weapons to a country engaged in a current conflict. An internal government assessment of whether Algeria’s involvement in Western Sahara meets this threshold is under way.

Towards greater European coherence

The European divergence explored in this paper reflects developments in the Maghreb and the varied political drivers of policy among member states. Domestic political concerns and pressure from Morocco, Algeria, and Tunisia mean that EU member states have to some degree renationalised their policies towards the Maghreb. But this approach comes at a cost. It hands power to Maghreb leaders to secure cooperation on their own terms by striking deals with the member states over whom they have most influence. This tilts European policy towards the short term. The result is that it becomes more difficult for Europeans to balance support for Tunisia with pressure to improve its treatment of migrants and undertake meaningful economic reforms, to prevent Morocco from using its leverage to extract concessions over Western Sahara, and to encourage Algeria towards greater economic openness.

Nevertheless, an opening now exists for the renewal of a more coordinated European approach. Some of the tensions of recent years are diminishing: relations between France and Morocco, and Spain and Algeria appear to be thawing. And the longer-term interests of EU member states are more convergent than current policies might suggest. The four most influential European countries all have a stake in promoting stability, opportunity, and energy transitions across the region. There is a broad inclination towards the ‘engagement-first’ approach, avoiding direct focus on human rights and democratic backsliding – but also an interest in encouraging more effective, inclusive, and accountable governance. Above all, Europeans have a shared interest in defining a form of engagement that gives member states greater influence. Greater coordination would help Europeans find a way of working with the difficult partners in the Maghreb that does not cede all initiative.

In the case of Tunisia, Europeans need to find a way to support the country while persuading Kais Saied to address some of its underlying problems. The EU must do what it can to prevent economic collapse in Tunisia, but will not benefit from simply maintaining the failing systemthat is now in place. The IMF deal remains the best way forward. But, if Saied is unwilling to sign up, the EU should offer only temporary support in exchange for steps to tackle public finances and increase opportunities. Saied might be more willing to sign an IMF agreement following Tunisia’s presidential election later this year. The EU should calibrate its cooperation on migration so that it does not support practices that violate basic rights.

In Algeria, a common European interest exists in maintaining supplies of gas in the short term while encouraging progress towards economic diversification and the transition to green energy. European countries are already working together on this, as with the German, Italian, and Austrian cooperation on a planned green hydrogen pipeline. Algeria remains a difficult country to influence. But Europeans should present a common message that will carry more weight than a series of uncoordinated approaches.

With Morocco, Europeans need to prevent the country from pursuing a constant campaign to ratchet up concessions on Western Sahara. The ECJ’s forthcoming appeal ruling on the inclusion of Western Sahara in trade and fisheries deals with the EU could provoke a crisis if the decision goes against Morocco and the European Commission. It could, however, also present an opportunity to put an end to the dynamic of Moroccan pressure and European accommodation. An adverse ruling would lead to Moroccan pressure on Spain and France to find a way to work around its terms, but the rule of law must be a red line for Europe. Europeans should also look for ways to amplify Moroccan cooperation by helping to improve economic inclusion in the country.

In all these cases, the centre of gravity common to European national policies represents a beneficial landing point for the EU’s engagement with the countries of the Maghreb. Europe should leverage the relationships that member states have built up, using them as the starting point to engage with regional leaders in support of an agenda that is coordinated within the EU. Such coordination would provide support for member states facing pressure from partners in the Maghreb. It would also help balance their short-term priorities with more structural goals, reinforcing a common message. A more coherent policy that takes account of member states’ imperatives but also of the EU’s longer-term interests is the most productive approach to a region whose importance for Europe will only continue to grow.