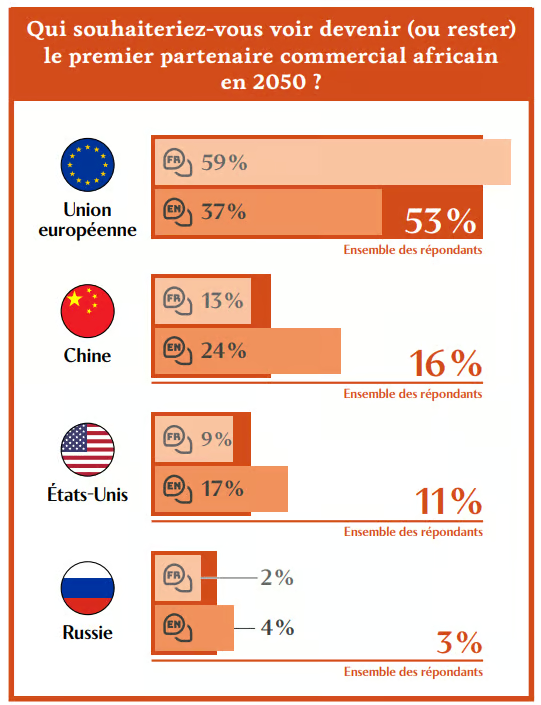

Europe remains the continent’s special partner. At least that is what the Choiseul Institute’s Africa 2050 survey reveals, which surveyed some 300 leaders among 34 African countries.

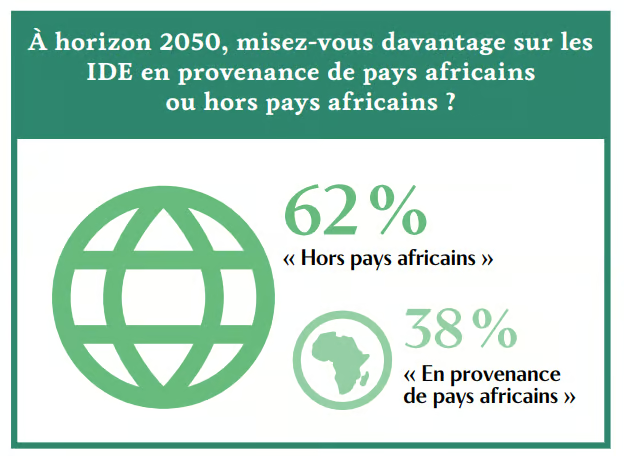

At dawn in 2050, when it is destined to become the world’s demographic giant, Africa is emerging as a strategic pivot in the global investment landscape. A recent “Africa 2050” survey conducted by the Choiseul Institute surveyed nearly 300 African leaders and revealed nuanced perspectives on a continent’s economic partnerships that fosters international foreign direct investment (FDIs) (62%).

Europe has a favourable image

In 2022, the inflow of FDI into Africa slowed sharply, capturing USD 45 billion, from USD 80 billion the year before. This decrease reflects international market adjustments in the context of a post-pandemic recovery. In this atmosphere of economic uncertainty, Europe has maintained, and continues to maintain, as a leading investor in Africa.

The survey reveals that 53% of African leaders put the European Union at the top of their choices as a trading partner of choice for future decades. Interest is in particular key players such as Germany (per 69% of respondents) and France (61%), which stand out as the preferred trading partners. This preference is particularly pronounced among French-speaking countries, although the battle for economic influence is hardening, pitting Europe against powers such as China (16%) and the United States (11%).

At the same time, Russia struggles to win, winning only 3% of the votes of the decision-makers interviewed. And 13% of participants go so far as to consider that Russia’s heightened influence in Africa could be “harmful” to the economic development of their countries and business.

China’s Recalibrated Influence

The EU’s “Global Gateway” programme, which is seen as a counterweight to China’s “New Silk Roads” project, is receiving a positive response, with more than half of the respondents perceiving it as a “promising” initiative. The plan, which aims to inject EUR 150 billion into Africa, aims to strengthen critical infrastructure.

For its part, China, currently the largest investor in Africa, is recalibrated. Loan cuts, driven by solvency concerns, are a step backwards in its relations with the continent. China’s presence remains indispensable by a significant proportion of the leaders surveyed, underscoring a complex relationship of economic necessity and strategic prudence.

The general feeling among African policymakers interviewed reveals a certain frustration: the current framework is not as attractive as it could be. Only 19% of survey respondents consider their country’s legislation to be fully adequate to improve its attractiveness. On the other hand, a 60% majority stress the urgent need for reforms to reinforce this attractiveness, while 20% consider that the laws in force are totally inadequate.