This edition includes entries on Cameroon, South Sudan, Venezuela and Western Sahara, offering a snapshot into emergent conflicts and crises in the next three to six months in a clear, accessible format, identifying triggers, key dates to watch and potential behaviour of conflict actors, to support global conflict prevention efforts.

The information provided below relies on our monthly global conflict tracker, CrisisWatch, and qualitative assessments provided by Crisis Group’s analysts based in or near conflict areas. The selection is not exhaustive, and should be read in conjunction with country/regional reports and other early warning products.

In the March-August 2024 edition of On the Horizon, we showcase entries in Cameroon, South Sudan, Venezuela and Western Sahara.

What to Watch in the Coming Weeks and Months

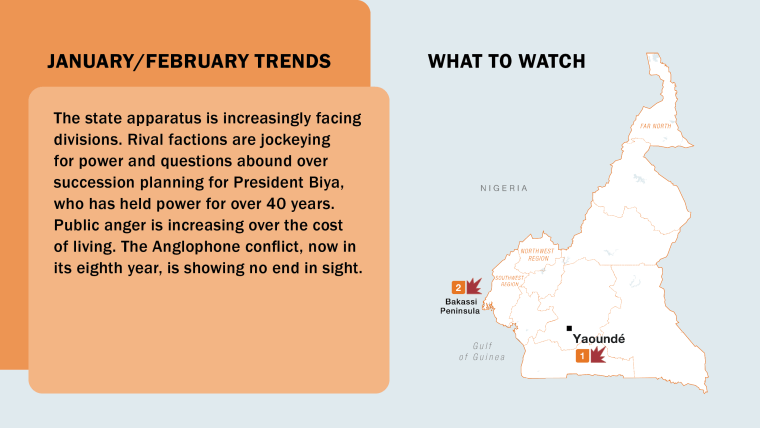

- The political system is at a turning point If Biya, 91, loses his grip on power, struggles among ruling party factions could turn violent or hamper the state’s capacity to function.

Political factions could leverage their influence over different elements of the security services and whip up existing ethnic tensions, especially via social media.

Any protests over the high cost of living, following the removal of fuel subsidies in February for example, could prompt calls for a political transition.

Biya may yet hang on and run in the 2025 presidential election, or pass the baton to a handpicked heir, but either could still trigger resistance from sections of the ruling party or a revamped opposition.

To Watch: Perceptions of Biya’s physical stamina; cost of living or new economic measures fuelling protests; political campaign in lead-up to 2025 election; inflammatory discourse on social media.

Potential Consequences:

If the looming crisis over Biya’s succession escalates to an all-out struggle for political and economic power, it could drive conflict from the periphery to the centre of the country. Existing ethnic tensions could breed violence.

Armed forces, currently fighting separatist militias in the Anglophone regions, battling Boko Haram insurgents in the Far North and policing several communities on the brink of community violence or facing kidnappings, could be pushed to step in to help stabilise the central institutions.- Violence will likely escalate in the Anglophone regions Anglophone separatists could launch more deadly attacks once they obtain expected larger volumes of weapons from various locations.

Biafra separatists in neighbouring Nigeria (known as IPOB), now allied to Ambazonia Governing Council (AGovC), one of Cameroon’s Anglophone factions, could step up attacks on Cameroonian soil, especially in oil-and gas-rich Bakassi peninsula.

The military will likely continue counter-insurgency operations in the absence of a meaningful dialogue.

Vigilantes groups/militias will likely continue violent attacks, with a heavy toll on civilians.

To Watch: Bakassi as a safe haven for armed groups; potential restart of mediation initiatives; deteriorated humanitarian conditions following the separatists’ rejection of international aid support; AU involvement in Cameroon to facilitate a settlement; reallocation of troops to Yaoundé in case of a national crisis.

Potential Consequences:

The military deal between separatists could lead to increased insecurity in the Gulf of Guinea, an area notorious for piracy, as well as renewed tensions in the Bakassi peninsula, where Cameroon and

Nigeria settled a long-standing border dispute in the 2000s.

As the conflict drags on with no resolution in sight, and hampered humanitarian assistance, the toll on civilians will likely grow. Lack of access to education (almost half the area’s schools have stopped functioning) in particular exacerbates the already serious issues plaguing Cameroon’s Anglophone communities and places an additional care burden on women.South Sudan

What to Watch in the Coming Weeks and Months

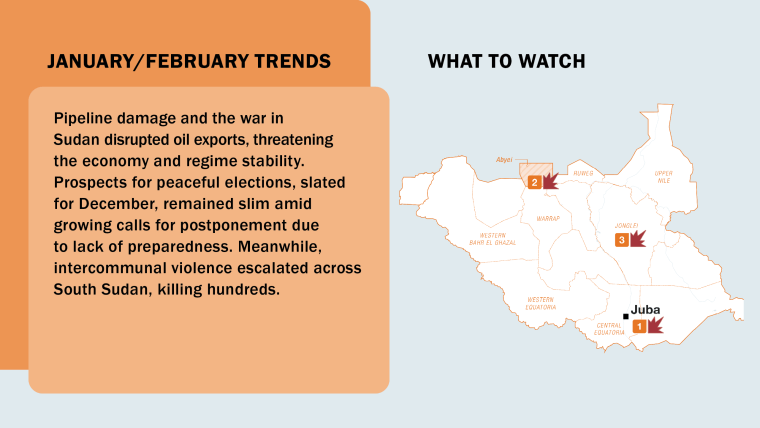

- Violence could escalate in the run up to and during elections President Kiir will likely continue to press for holding elections by December.

The National Electoral Commission (NEC) will likely face major obstacles to deliver on the electoral calendar, including demarcating new constituencies by June.

VP Riek Machar will likely continue to call for a new constitution and the unification of previously warring armed forces, or else Sudan People’s Liberation Movement-in-Opposition (SPLM-IO) will boycott elections.

To Watch: Oil revenue could affect the economy, including budget allocated for elections; when NEC finalises the demarcation of political constituencies; possible extension of political transition; and ways SPLM-IO- government relations develop, including through dialogue initiatives.

Potential Consequences:

Tensions over the boundaries of new constituencies could fuel deadly clashes between local militias, for example in Upper Nile, between Shilluk, Dinka and Nuer communities. Electoral tensions could also strain peace talks and fuel local conflicts eg, between National Salvation Front (NAS) and the government in Central Equatoria, in Jonglei or between rebel commander Stephen Buay’s forces and the government in Mayom county and Ruweng Administrative Area.

Fighting for positions and gubernatorial nominations within the ruling party or between rival candidates including from SPLM-IO, could fuel violence eg, in Western Equatoria, in Western Bahr el Ghazal, between Dinka elites surrounding Kiir in Warrap, between government (or government aligned) forces eg, in Northern Bahr el Ghazal, between government factions in Greater Pibor Administrative Area, and/or between the SPLM-IO and government in Southern Unity state. SPLM-IO could return to rebellion if they withdraw from the peace agreement.- Sudan’s civil war could spill over into South Sudan Sudan’s paramilitary Rapid Support Forces (RSF) could destabilise disputed Abyei area, notably if it tries to capture oilfields in and around Abyei from the Sudanese army.

Buay and Nuer fighters will likely continue fighting alongside the RSF, raising the possibility of a South Sudanese rebel group accessing RSF arms and ammunition, battlefield experience and training camps.

If Kiir’s government is alienating Nuer spiritual leader Gai Machiek, his armed followers might join Buay.

To Watch: Evolution of Sudanese conflict and who controls oil fields in Abyei box and beyond.

Potential Consequences:

If there is no oil, the economy will collapse (90 per cent of GDP is oil exports), putting more stress on an already fragile state.- South Sudan could further disintegrate along ethnic lines Authorities will likely continue to struggle to pay salaries, resorting to extorting ordinary people via checkpoints, conscription and taxation.

Ethnic violence will likely rise, especially in places like Jonglei and Abyei where fighting between Twic Dinka from Warrap state and Ngok Dinka from Abyei has already claimed hundreds of lives in recent months.

To Watch: Climate disasters set to worsen situation; Jonglei State and Abyei area.

Potential Consequences:

As friction grows along ethnic lines, violent clashes will likely multiply with a high toll on civilians. It will also heighten the risk of Kiir being ousted, and further weaken the state apparatus. All this carries with it the risk of complete fragmentation of the country.Venezuela

What to Watch in the Coming Weeks and Months

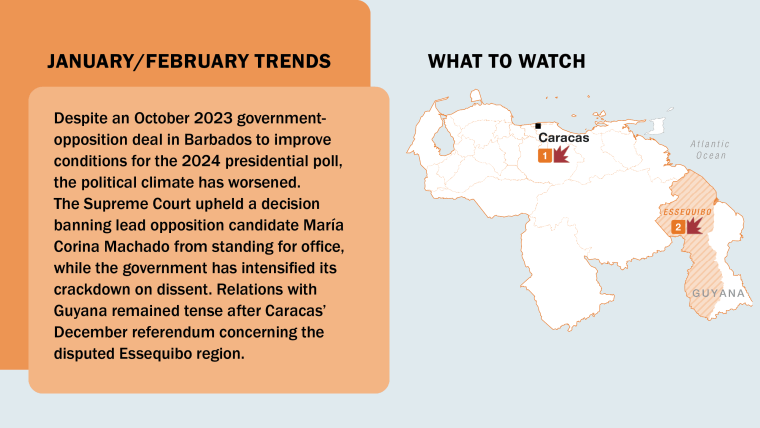

- Political tensions could grow in the lead-up to presidential elections Authorities will likely continue their heavy crackdown on civil society, and place severe restrictions on elections planned for 28 July.

The opposition could fracture as some of its leaders may decide to run for elections, while others abandon the electoral route.

U.S. administration could reverse sanctions relief, notably in April, when the licence lifting restrictions on the oil and gas sectors sunsets.

To Watch: Invitation to election observers; reimposition of U.S. sanctions; Maduro’s Russia visit; opposition decision on election participation without Machado; heightened tension with Guyana.

Potential Consequences:

Reimposition of U.S. sanctions would signal an end of the political opening created by Barbados and prolong the humanitarian emergency.

A poll that foreign actors treat as illegitimate could return Venezuela to a full-blown political crisis, triggering increased domestic repression, regional isolation and new waves of migration to swell the existing diaspora of over eight million.- Sabre rattling over Essequibo will likely continue, fuelling tensions with Guyana Caracas could continue using its dispute with Guyana over the oil-rich Essequibo region to whip up nationalist sentiment ahead of the election and sideline the opposition.

Venezuelan troops will likely continue build-up near the border.

Guyana will likely continue to reject compromise over Essequibo, instead seeking foreign military and diplomatic support.

To Watch: Further military build-up at land border or offshore eg, deployment of warships; high level visits or pitched rhetoric from outside actors; Caracas could fabricate a border incident as a pretext to suspend the presidential race.

Potential Consequences:

Though low risk, some fear Caracas could trigger a conflict with Guyana to enforce its claim over the territory.

If clashes were to occur, eg, offshore, Caracas would face a massive backlash from international actors and harm its own efforts to end diplomatic isolation.Western Sahara

What to Watch in the Coming Weeks and Months

- A gradual escalation of hostilities could spark a broader conflict Polisario could launch more attacks on Moroccan territory, targeting foreign economic interests; deadly attacks targeting civilians, intentionally or unintentionally, could flare, especially as younger members dissent with the leadership’s more moderate approach and may be tempted to escalate attacks.

Morocco will likely continue to use drones on Polisario-held territory, which could spark an accidental escalation, especially if Algerian nationals (who drive through the territory to transport goods to Mauritania) are killed.

Algeria could step up its retaliatory steps against Morocco, potentially fuelling a direct military confrontation.

To Watch: Civilian deaths on both sides could trigger retaliatory attacks; Israel’s military operations in Gaza could stoke anger within Polisario’s youth wing against Morocco, which has normalised relations with Israel.

Potential Consequences:

Tit-for-tat attacks between Morocco on one hand and the Polisario and its main ally, Algeria, on the other, may increase the risk of a regional escalation, though major conflict is unlikely. Should it erupt however, it could divert resources away from migration control in both countries, fuelling irregular departures to Europe, and encourage the Polisario and Algeria to target economic infrastructure (such as phosphates) in Western Sahara and potentially in the south of Morocco, too.- A diplomatic standoff over the UN presence could fuel hostilities The UN Special Envoy will likely continue to struggle to present a new plan, meaning no autonomy plan, no referendum and no ceasefire are on the table.

Polisario could show signs of frustration at a stalled UN process by suspending fuel and water resupply operations, via Morocco, of the UN mission in Polisario-held territory.

If the UN cannot operate/withdraws, Morocco could take over the UN buffer zone, which means they could be face to face with Algerian soldiers in Western Sahara and be targeted by the Polisario directly from Algerian territory.

To Watch: The envoy’s plan for the resumption of negotiations; build-up of troops along the sand berm; movement of heavy artillery in the Bir Gandouz area in Morocco-controlled Western Sahara.

Potential Consequences:

A direct confrontation between Morocco and Algeria could take place in Western Sahara, potentially affecting those displaced near Tindouf, Algeria. It could also have broader repercussions on other Maghreb and Sahelian countries.