This bloc goes to eleven. At its summit on Thursday in Johannesburg, the BRICS group of Brazil, Russia, India, China, and South Africa announced that its membership is more than doubling. Argentina, Egypt, Ethiopia, Iran, the United Arab Emirates (UAE), and Saudi Arabia have been invited to join the group in January. A formidable rival to the Group of Seven (G7) democratic powers could reshape geoeconomics and geopolitics across a range of issues, from Russia’s war in Ukraine to the status of the US dollar as the world’s reserve currency. Does the yet-to-be-acronymed group amount to such a rival? Atlantic Council experts share their insights below.

With six new members, BRICS is tilting toward China

At the BRICS Summit, the group has just agreed to admit six new members: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE; and to consider other prospective countries. Strongly supported by China and Russia, the inclusion of Iran has strengthened the anti-US axis in the BRICS—probably making it more antagonistic and more challenging for the United States and the West to deal with it as an organization which contains two internationally sanctioned members. This decision reflects the sway of China together with Russia in the group and could not be very comfortable for moderate members like India and Brazil.

Saudi Arabia and the UAE would add important economic heft to the group, which now includes several important Organization of Petroleum Exporting Countries members as well as Russia—giving it a relevancy in the geopolitics of the global oil market. Saudi Arabia and Argentina, both members of the Group of Twenty (G20), could enable the BRICS to help coordinate the views of most of the emerging market G20 members. In this sense, the group could serve as an informal counterpart to the G7, which coordinates developed countries’ positions in advance of G20 meetings. However, with a strong China-Russia-Iran axis, the group may end up pushing for anti-Western positions, making compromises in the G20 more difficult to reach.

The fact that Saudi Arabia, Iran, and the UAE will be members would have been unthinkable until recently and shows another facet of the diplomatic reconciliation among the three countries—with intermediation by China.

The BRICS also agreed at the summit to accelerate the use of their local currencies to settle trade and investment transactions among themselves—continuing to reduce their reliance on the US dollar-based global payment and financial system.

Given these outcomes, it is understandable for Chinese leader Xi Jinping to say that “this is a historic occasion . . . that brings new rigor to the bloc.”

—Hung Tran is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center.

New Middle Eastern BRICS members highlight shifting geopolitical winds

The decision by the BRICS nations to invite four Middle East countries to join their ranks—Saudi Arabia, the UAE, Egypt, and Iran—highlights shifting geopolitical winds as much as it reflects an opportunity for closer economic integration with those states.

For Saudi Arabia and the UAE, inclusion in the group is potentially symbiotic, as both are looking to engage and deepen cooperation with non-Western countries and diversify their economic partnerships as an additional hedge against the United States. Riyadh and Abu Dhabi would probably view a decision to join as furthering their goal to be viewed as not just important regional leaders, but global ones. For the BRICS states, the inclusion of Saudi Arabia and the UAE would bring new investment and trade opportunities as the former seeks to quickly diversify and scale up its economy across a range of new, non-fossil fuel industries and the latter is home to the region’s leading financial hub in Dubai.

Egypt, which currently faces a massive financial and economic crisis, would not appear to be a prime candidate for inclusion on paper, but Moscow and Beijing probably view inviting Cairo as akin to taking a flier—enhancing relations now in hopes of being able to strategically leverage Egyptian assets in the coming decades. Cairo’s key strategic location, control of the Suez Canal, and newly discovered gas fields are all probably viewed by the BRICS group as potentially lucrative, both economically and politically, over the coming decades.

The decision to include Iran was almost certainly driven by Russia and China, as the country’s massive gas and oil reserves were likely a selling point for Beijing in convincing Brasilia, Pretoria, and New Delhi to go along with the invitation, knowing it will further fuel tensions with Washington. Inclusion in the BRICS won’t transform Iran’s economy overnight. Iran views relations with China as providing an economic lifeline, given the poor state of the economy, which continues to reel from a bevy of US sanctions. But over time, groupings such as the BRICS have the potential to undermine Washington’s power when it comes to punishing or isolating countries pursuing policies that contradict US interests, especially if they seek alternative systems and methods for trade and payment over which Washington lacks the same leverage that it has today over SWIFT, for example.

In the view of the BRICS states, including the newly invited members, reducing global US economic and financial leverage would create a more level playing field, while countries such as Iran would view it as a way to further reduce the impact of sanctions. For Washington, it should be a warning: the need to strengthen and renew relationships with allies has never been more important. The emerging world might be multipolar, but some poles will be closer than others.

—Jonathan Panikoff is the director of the Scowcroft Middle East Security Initiative at the Atlantic Council’s Middle East Program.

BRICS has big ambitions, but it also faces new challenges

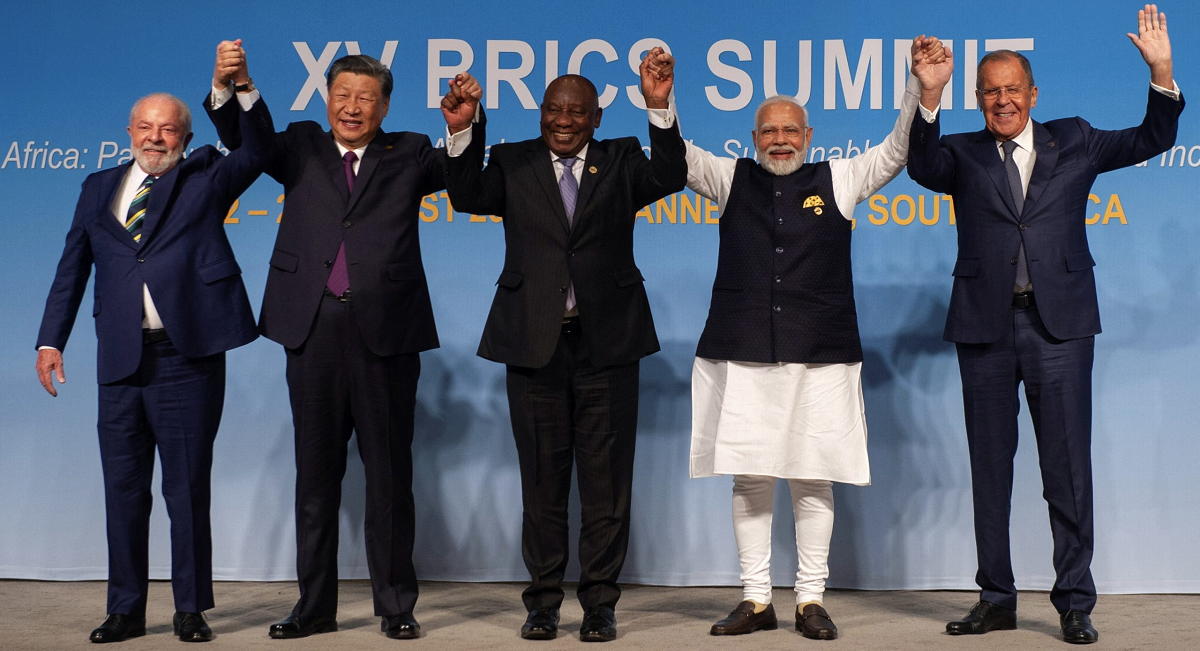

They will be eleven now. Six new countries, including two African countries, Egypt and Ethiopia, will be added to the five BRICS members on January 1, 2024. It was a priority of this fifteenth BRICS Summit in Johannesburg. “The BRICS are starting a new chapter,” said South African President Cyril Ramaphosa, who hosted the summit.

The current five-member BRICS group represents a quarter of the world’s wealth and brings together 42 percent of the world’s population. But now, the BRICS will face new challenges. First, this group is very diverse, with unequal growth and rivaling interests. The importance of China, which represents 70 percent of the group’s gross domestic product, is a problem for India. Some of the BRICS countries, including South Africa, want to save its trade relations with the United States and don’t want to be dragged into the Cold War strategy pursued by Russia. Meanwhile, Putin decided not to join the summit in person, most likely due to an international arrest warrant for alleged war crimes committed in his brutal invasion of Ukraine. And with the new membership of authoritarian regimes such as Iran, the question arises: Do Africans really need the Middle East’s problems brought into this group? If they want to do business with Israel, what will Iran say?

Beyond this membership issue, the BRICS group should be taken seriously. The high-level attendance, from Xi to Modi, reveals a lot of the bloc’s big ambitions to build an alternative multilateralism, starting with challenging the dollar and strengthening the New Development Bank without conditionality. Washington is monitoring the situation closely: at the opening of the summit, the Biden administration announced its willingness to strengthen the financing capacities of the International Monetary Fund and the World Bank on the occasion of the next G20 summit in India on September 9 and 10. US National Security Advisor Jake Sullivan explained on Tuesday: “Our IMF and World Bank proposals will generate nearly $50 billion in lending for middle income and poor countries from the United States alone. And because our expectation is that our allies and partners will also contribute, we see these proposals ultimately leveraging over $200 billion.” The emergency will probably require much more.

—Rama Yade is senior director of the Atlantic Council’s Africa Center and senior fellow for the Europe Center.

Beijing’s vision for the bloc is driving BRICS expansion

With the addition of six new members and a ninety-four-paragraph leaders’ statement teeming with coverage of priority issues for emerging and developing countries, the BRICS grouping is trying to cement its position as a platform for and champion of the Global South. This aligns particularly closely with Beijing’s vision for the grouping, and the six new members—Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE—probably also accommodate Chinese preferences. Representation from the economic heavyweight region of Southeast Asia is notably missing, potentially reflecting Beijing’s strained ties in the region. Indonesia would have been a logical choice, having attended the “Friends of BRICS” event in June. Instead, four of the six new members hail from the Middle East, a region into which Beijing has steadily expanded its economic, military, and political ties in the past few years.

Ironically, the expanded BRICS group will make it harder to operationalize its mission of advancing Global South interests. The BRICS has always been a grouping heavier on symbolism than on substance. Even its tangible outputs, such as the painstakingly negotiated and coordinated New Development Bank, have not notably shifted the global governance landscape in the ways the group hoped. Adding more diverging voices to the BRICS will only increase the challenge of reaching agreement on key areas the group hopes to make progress on, such as reducing the use of local currencies in trade and expanding their correspondent banking ties.

Nonetheless, the group is clearly gaining traction across the Global South, with more than forty countries interested in joining the BRICS, according to this year’s chair, South Africa, and with BRICS leaders leaving open the possibility for further expansion in their joint statement. Perhaps simply offering developing countries the chance for a seat at the table—regardless of whether that seat comes with tangible benefits—will be enough for the group to continue appealing to and garnering support from the Global South.

—Colleen Cottle is the deputy director of the Atlantic Council’s Global China Hub and previously spent over a dozen years at the Central Intelligence Agency serving in a variety of roles covering East and South Asia.

On the ground in Johannesburg, Putin’s absence stuck out

Wednesday had delegates at the BRICS Summit—the first to be held in person since the outbreak of the COVID-19 pandemic—here in Johannesburg looking up and down. With a proud Indian Prime Minister Narendra Modi present, they applauded the landing of the Chandrayaan-3 spacecraft on the moon. And hours later, news broke of the crash of a private jet in Russia said to be carrying Wagner Group boss Yevgeniy Progozhin and his deputy.

While Russian President Vladimir Putin’s absence stuck out like a sore thumb, not to be outdone by the India lunar fest and Xi showering host country South Africa with money, he managed to steal the news cycle by neutralizing a main opponent just as leaders were sitting down to dinner yesterday. One wonders if any of them had food tasters present.

Fireworks aside, the summit managed to generate headlines on Thursday with an expansion that would more than double the group’s membership. Saudi Arabia and the UAE will be appreciated for their financial heft and ability to inject cash into the New Development Bank, the bloc’s lending facility. The expansion also furthers Saudi leaders’ efforts to become a global heavyweight and powerwash their image after the ghastly 2018 murder of journalist Jamal Khashoggi. The admittance of Argentina, Egypt, and Ethiopia gives South America and Africa more representation. Iran’s membership helps burnish BRICS’s image as an all-inclusive club—one that lets in countries no matter how appalling their human rights record. Indonesia was expected to join, but is said to have asked for more time to prepare.

Over the longer term, BRICS leaders have pledged to sort out intra-African trade. Trade among African countries makes up only 14.4 percent of African exports, and there’s a push to get that to increase by facilitating trade between countries in their own respective currencies. For instance, if Kenya wants to trade with Djibouti, why does a third currency like the US dollar have to be involved? If BRICS can sort that out in a continent that uses more than forty different currencies, it will be a major achievement.

Finally, with the G7, G20, and Asia-Pacific Economic Cooperation degenerating into boxing rings for tantrum diplomacy, where final communiques either get watered down or not issued at all, perhaps it is worth giving BRICS a chance to reinvent multilateral cooperation. This reinvention cannot come soon enough—especially for poorer countries who need help the most.

—Michael Bociurkiw is a nonresident senior fellow at the Atlantic Council’s Eurasia Center. He is in Johannesburg, South Africa, for the BRICS Summit.

The summit may have pushed US and Brazil further apart

Brazilian President Luiz Inácio Lula da Silva has been walking a fine line in his foreign policy. The BRICS Summit might have just pushed Brasília and Washington further apart.

Lula’s foreign policy approach is consistent with priorities from his past two terms in office. These include the need for a more democratic global order in which countries such as Brazil, India, and South Africa have equal footing. But the current geopolitical dynamics have shifted significantly.

Lula and Finance Minister Fernando Haddad publicly defended the role of the BRICS not as a counterpoint to the United States or the hegemony of the G7, but as a contributor to a more diplomatic and inclusive global order. However, given current geopolitical sensitivities, to what extent aren’t alliances—as indirect as they may be—with countries such as Russia and Iran not harming Brazil’s credibility abroad further?

The expansion of the BRICS to include countries like Iran is challenging. Earlier this year, Brazil allowed Iranian warships to dock in its coast, which caused discomfort in Washington. And that is heightened by Brazil’s position with regard to Russia’s war on Ukraine, seen as not strong enough for Washington, and its friendly relationship vis-à-vis China.

Lula’s positions are consistent with Brazil’s long-term nonalignment and noninterventionist principles. Brazil was the only country of the BRICS to condemn Russia’s invasion of Ukraine at the United Nations last year; China is Brazil’s main trading partner and former President Dilma Rousseff is the new president of the BRICS’ New Development Bank. On the other hand, Brazil pursues stronger ties on trade, investment, climate, and other mutual priorities with the United States, which Lula visited within his first month in office. Brazil has also been pursuing stronger ties with Europe, with continued negotiations of the Mercosur-EU trade agreement.

As Brazil pushes for a reshaped UN Security Council, Lula’s possible upcoming meeting with US President Joe Biden in New York becomes even more significant. What’s on Washington’s agenda?

—Valentina Sader is a deputy director at the Atlantic Council’s Adrienne Arsht Latin America Center, where she leads the Center’s work on Brazil, gender equality, and diversity, and manages the Center’s Advisory Council.

For the BRICS to be effective in the long term, India and China must resolve their disputes

In the run-up to the BRICS Summit, Indian leaders had continually expressed their intentions for the platform, including issues like the response to the COVID-19 pandemic, the supply chain and energy crisis, the impact of the invasion of Ukraine, and the inability of Western-led multilateral platforms to manage global crises. For countries like India, the BRICS represent an important bloc that reflects 40 percent of the global population and $27.7 trillion of the global economy. However, with the concentration of economic power in Western-led institutions since World War II, India and other members of the Global South felt largely overlooked. Indian leaders believe that the BRICS Summit could be the platform that can bring a new and more equitable perspective to global cooperation and problem solving. Thus, India would position the 2023 BRICS Summit to raise the de facto voice of the Global South.

The timing of the BRICS Summit could not have been better for Modi. Nestled between his state visit to the United States and India’s G20 presidency, Modi has used the global stage to declare and reinforce India as the “voice of the Global South” and the new growth engine of the world.

Before this year, generally speaking, the BRICS was a grouping in name only. There was some headline overlap between the countries, but they diverged to different degrees in their long-term strategic and economic interests. The expansion of BRICS from five countries to eleven may result in India and the group gaining leverage (at least optically), as the expanded bloc includes a greater concentration of energy-producing countries, as well as potential collaboration on shifting trade transactions away from the dollar. The members will try to use the expansion to push for changes at the United Nations and other global institutions. However, for the BRICS to be effective over the long term, India and China will need to resolve their border challenges and collaborate on tough global issues as well as the deployment of capital for developing economies. If India is truly to take on the role of the “voice of the Global South,” managing these disparate interests with one voice may prove to be a greater task than what it bargained for.

—Kapil Sharma is the senior director and a senior fellow at the Atlantic Council’s South Asia Center.

With BRICS membership, Iran is furthering its ‘Look to the East’ strategy

“Neither West nor East” was an ethos adopted by the founder of the Islamic Republic of Iran, Ayatollah Ruhollah Khomeini. However, Tehran leaned West after signing the 2015 multilateral deal known as the Joint Comprehensive Plan of Action (JCPOA). When the Donald Trump administration withdrew from the JCPOA in 2018—despite Tehran not violating the deal at the time—it quickly became apparent that Iran could not rely on the West—that is, on European countries—to help circumvent reimposed US sanctions.

Tehran has since adopted a “Look to the East” strategy, which incorporates increased economic, political, and defense ties with China and Russia. Just this July, Iran joined the Shanghai Cooperation Organization (an Eurasian political, security, and economic organization founded by China and Russia) after obtaining observer status in 2005. It’s not surprising that a BRICS membership would follow suit.

—Holly Dagres is a nonresident senior fellow with the Atlantic Council’s Middle East Programs.

Expansion is a double-edged sword for BRICS’ ambitions

Expansion will alter the fabric of the BRICS institution in two major ways. First, it could change the structure of negotiations internally. The new members vary tremendously in economic size, macroeconomic context, and their ties with non-BRICS economies. BRICS makes decisions through consensus, and achieving consensus among eleven countries with diverse economies, geographies, and interests is far more difficult that achieving it among five. The members may all agree on principles, such as increasing trade in non-dollar currencies. But the addition of new members will significantly slow down some of their more ambitious aspirations once they begin negotiating the nitty-gritty of those projects, for instance, that of a shared currency. To ensure utility and coherence of the institution over the longer term, BRICS may instead choose to stick with low-hanging fruit.

Second, the addition of new members could move the institution away from its geoeconomic origins of five countries on similar growth trajectories to a more geopolitically charged organization made up of different kinds of economies. Russia and China led the calls for accelerated expansion, and attempts to position BRICS as a counterweight to the G7 will make countries such as India and Brazil, which are already walking a delicate balance with the West, uncomfortable.

The addition of six new full members will nevertheless make BRICS the premier convening for emerging markets, at least in the short term, when the disadvantages of scale will not yet be apparent. More than twenty countries had already formally applied to join BRICS prior to this year’s summit, and more will likely be interested for fear of missing out.

—Mrugank Bhusari is an assistant director at the Atlantic Council GeoEconomics Center.