Key Takeaways:

Horn of Africa. Ethiopia signed a memorandum of understanding with the de facto independent Somaliland Republic, a breakaway region of Somalia, to lease a naval port that will give it Red Sea access in exchange for formally recognizing Somaliland. The port deal has severely strained Somali-Ethiopian relations and increased anti-Ethiopian sentiment in southern Somalia, which will likely weaken regional counterterrorism cooperation and energize al Shabaab. Ethiopia’s African Red Sea neighbors in Djibouti, Egypt, and Eritrea will likely view an Ethiopian base as a threat, while the United Arab Emirates’ (UAE) strong ties with the Ethiopian government will strengthen the Emiratis’ position in its regional rivalry with other Gulf countries, such as Saudi Arabia and Qatar.

Sahel. Al Qaeda–linked militants have continued strengthening in central and southern Mali and across the border in northern Burkina Faso. Regional security forces likely lack the capacity to degrade the militants’ support zones, which allow the militants to continue launching attacks that temporarily overwhelm security force positions to delegitimize both countries’ governments and extend its support zones without establishing direct territorial control.

Assessments:

Horn of Africa.

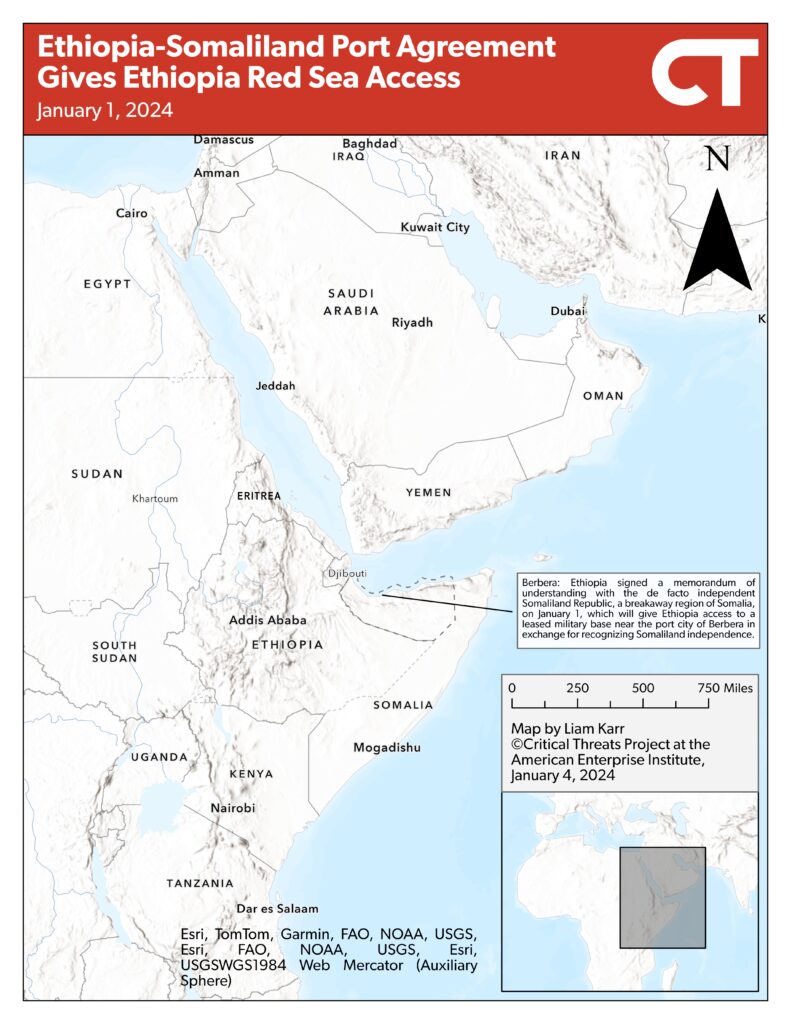

Ethiopia signed a memorandum of understanding with the de facto independent Somaliland Republic, a breakaway region of Somalia, on January 1, which will give Ethiopia access to the Red Sea in exchange for recognizing Somaliland independence. Ethiopian Prime Minister Abiy Ahmed described Red Sea access in July and October 2023 as an existential issue and “natural right” that Ethiopia would fight for if it could not secure it through peaceful means.[1] The memorandum of understanding grants Ethiopia access to a leased military base near the port city of Berbera along Somaliland’s coast on the Gulf of Aden.[2] The port will give Ethiopia access to Red Sea shipping lanes via the Bab al Mandeb strait between Djibouti and Yemen that connects the Red Sea and the Gulf of Aden.

Figure 1. Ethiopia-Somaliland Port Agreement Gives Ethiopia Red Sea Access

Source: Liam Karr.

Economic issues are a significant driver of Abiy’s move to secure the deal. The Ethiopian economy has struggled since the COVID-19 pandemic in 2020 and the two-year civil war that ended in 2022 and related sanctions.[3] This has led Ethiopia to make multiple debt relief requests since 2021 and default on bond payments in December 2023.[4] Ethiopia also pays at least $1 billion in port fees annually to Djibouti.[5] Abiy asked Djibouti to reduce the fees in 2022.[6] Djibouti declined, however, because its economy relies on rents and services secured from Ethiopian shipping fees. Djibouti’s port handles 95 percent of inbound and outbound trade from Ethiopia.[7] The logistics surrounding this trade drive Djibouti’s services sector, which accounts for almost 76 percent of Djibouti’s gross domestic product.[8]

The Somaliland president and Ethiopian foreign minister said that Ethiopia would formally recognize Somaliland and give Somaliland a proportional stake in Ethiopian Airlines in return for the base.[9] However, the Ethiopian government’s official readout of the deal was less committal and said that Ethiopia would “make an in-depth assessment towards taking a position regarding the efforts of Somaliland to gain recognition.”[10] Taiwan is the only country that has formally recognized Somaliland’s independence from Somalia since Somaliland declared autonomy in 1991, although Somaliland has significant diplomatic and economic relations with numerous countries.[11]

On January 2, the Somali Federal Government (SFG) rejected the port deal as “null and void” as it has no legal basis and violates Somali sovereignty and international law, and it threatened to retaliate if Ethiopia followed through on the deal.[12] In an address to parliament on January 2, the Somali president reiterated the stance that Somaliland is a member state of the Somali Federal Republic and that only the federal government has the authority to lease land to foreign powers.[13] The SFG also warned that it reserved the right to respond in any means and legal process necessary.[14] Shortly after Ethiopia and Somaliland announced the deal, Somalia recalled its ambassador to Ethiopia for consultations.[15] Somalia temporarily cut ties with Kenya in 2020 after it announced plans to open a consulate in Somaliland, which sets a precedent for further diplomatic retaliation.[16]

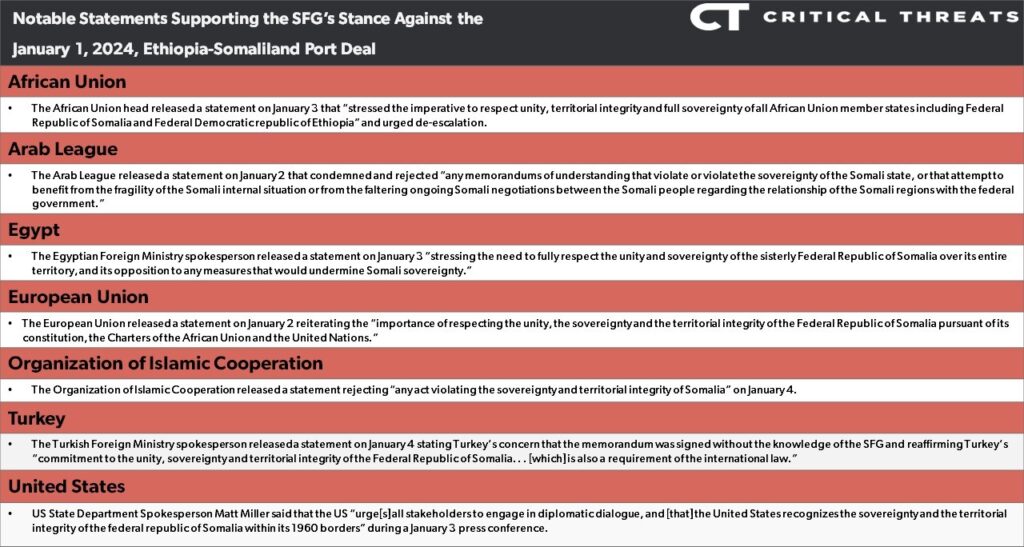

The SFG is attempting to rally its allies to amplify diplomatic pressure on Ethiopia and Somaliland because it is too weak to disrupt the deal unilaterally.[17] The Somali president called on the UN Security Council, African Union (AU), Organization of Islamic Cooperation (OIC), Arab League, and the East Africa trade block—Intergovernmental Authority on Development (IGAD)—to “unequivocally condemn Ethiopia’s serious violations and force it to return to the confines of international laws” in remarks on January 2.[18] The Arab League, Egyptian foreign ministry spokesperson, and OIC released separate statements condemning the deal as a violation of Somalia’s sovereignty on January 3 and 4.[19] The AU, EU, Turkey, and US made separate statements between January 2 and 4 urging de-escalation and respect for Somalia’s sovereignty, indicating support for the SFG without explicitly rejecting the deal.[20] IGAD took a more neutral stance by only calling for a peaceful resolution that “upholds shared values.”[21] Somalia condemned the IGAD response for falling short of condemning Ethiopia and called on the IGAD executive secretary—an Ethiopian—to withdraw the statement.[22]

Figure 2. Notable Statements Supporting the SFG’s Stance Against the January 1, 2024, Ethiopia-Somaliland Port Deal

Source: Liam Karr; https://au.int/en/pressreleases/20230103/chairperson-commission-calls-mutual-respect-between-ethiopia-somalia; http://www.leagueofarabstates.net/ar/news/Pages/NewsDetails.aspx?RID=4418; https://x.com/MfaEgypt/status/1742536606144147698?s=20; https://www.eeas.europa.eu/eeas/ethiopiasomalia-statement-spokesperson-territorial-integrity-federal-republic-somalia_en; https://x.com/OIC_OCI/status/1742837130705944769?s=20; https://x.com/SpoxTR_MFA/status/1742918494143062319?s=20; https://www.state.gov/briefings/department-press-briefing-january-3-2024/#post-521014-HORNOFAFRICA

The rupture of Somali-Ethiopian relations would weaken regional counterterrorism cooperation. Somalia cutting diplomatic ties with Ethiopia would almost certainly affect the continued legal presence of Ethiopian soldiers in Somalia, which are fighting the al Qaeda affiliate al Shabaab.[23] Ethiopia currently has at least 4,000 troops deployed in Somalia as part of the AU Transitional Mission in Somalia (ATMIS) and another 1,000 soldiers deployed as part of bilateral agreements with Somalia.[24] Ethiopian forces comprise between a quarter and a third of the 14,000-strong ATMIS force and are responsible for sectors in central and southwestern Somalia that border Ethiopia.[25] ATMIS is undergoing a multiphase drawdown to withdraw entirely by the end of 2024, but it remains crucial to bolstering the SFG’s capacity as Somali forces increase their size and clear al Shabaab from contested areas of the country in preparation for the SFG assuming responsibility for its own security.[26]

An Ethiopian withdrawal would also significantly complicate the SFG’s plans to clear al Shabaab’s main havens in southern Somalia by the end of 2024, given it has courted Ethiopian support for the offensive.[27] At least 1,000 non-ATMIS Ethiopian troops deployed to Somalia in mid-2023 at the SFG’s behest to supplement a planned offensive against al Shabaab’s primary leadership and governance havens in southern Somalia.[28] Several political and operational challenges have so far prevented any such offensive, but the Somali president insisted in December that operations would begin soon and be completed before the ATMIS withdrawal at the end of 2024.[29]

Al Shabaab will likely increase its attacks against Ethiopian forces in the Horn of Africa to capitalize on anti-Ethiopian sentiment among Somalis to boost funding and recruitment. The Ethiopia-Somaliland port deal prompted an anti-Ethiopian backlash in southern Somalia.[30] Al Shabaab has historically capitalized on anti-Ethiopian sentiment to boost support among the Somali population across the Horn of Africa.[31] The Somali president and head of the Arab League separately warned that Ethiopia’s move would fuel a dangerous rise in extremism.[32]

Al Shabaab’s spokesperson spoke out against the agreement as “invalid” on January 2 and threatened to retaliate.[33] Al Shabaab regularly attacks AU forces in Somalia and carried out two suicide vehicle-borne improvised explosive device (SVBIED) attacks against Ethiopian positions in southwestern Somalia in June 2023.[34] Al Shabaab also has the capability to carry out attacks inside Ethiopia. Al Shabaab last launched a major incursion into Ethiopia in the summer of 2022, and nearly 500 surviving militants established a rear base in the Bale Mountains along Ethiopia’s southeastern border with Kenya.[35]

Al Shabaab brands Ethiopia as Somali Muslims’ archenemy and has historically advanced a pan-Somali narrative rooted in anti-Ethiopian sentiment to boost recruiting and funding support among the Somali population spread across the Horn of Africa.[36] This rhetoric frames Ethiopia as a foreign, Christian occupier in ethnically Somali lands that seeks to “enslave Somalia, revive an Ethiopian empire, and control Somalia’s seaports.”[37] This narrative played a significant part in al Shabaab’s initial rise after the Ethiopian invasion of Somalia in 2006 that led to al Shabaab nearly toppling the internationally recognized government before the AU intervention in 2011.[38] The al Shabaab spokesperson’s statement on January 2 reiterated this framing and called on Somalis to “take up arms to wage jihad” against Ethiopia.[39] The spokesperson also compared Ethiopia to Israel and warned that Ethiopia will continue to encroach on Somalia the same way Israel has “occupied the land of Palestine.”[40]

Al Shabaab launched a massive offensive involving at least 2,000 fighters into Ethiopia in July 2022.[41] It was the group’s first attack along the Ethiopian border since at least 2016.[42] Ethiopian forces reestablished control of the Ethiopian border after two weeks, but local and diplomatic sources said the attack’s primary aim was to enable several hundred militants to infiltrate Ethiopia and set up a base in the Bale Mountains near Ethiopia’s southeastern border with Kenya.[43] Initial estimates in September 2022 said that at least 100 fighters reached the mountains, but more recent sources in September 2023 say that roughly 500 fighters are in the area.[44] Al Shabaab also regularly attacks Ethiopian forces in Somalia and carried out two SVBIED attacks against Ethiopian positions in southwestern Somalia in June 2023 for the first time since its 2022 offensive.[45]

Al Shabaab has not claimed any attacks in Ethiopia since mid-2022 to maintain the enclave’s operational security.[46] It is unclear if al Shabaab views the Ethiopia-Somaliland deal as either a significant enough threat to its legitimacy as a defender of Somali sovereignty or a significant enough opportunity to gain support that it would change this calculus.Ethiopia’s African Red Sea neighbors in Djibouti, Egypt, and Eritrea will likely view an Ethiopian base as a threat. Previous reports discussing partial Ethiopian ownership of the Emirati port in Berbera in 2016 estimated that Berbera would capture 30 percent of Ethiopia’s cargo volume from Djibouti, which would threaten Djibouti’s fragile economy.[47]

Egypt has been at odds with Ethiopia over the latter’s Grand Ethiopian Renaissance Dam (GERD) project since Ethiopia began its construction on the Nile River in 2011.[48] Egypt and Sudan have argued that Ethiopia’s GERD should not be filled without a legally binding agreement that resolves concerns about the dam’s downstream effects on Egypt and Sudan.[49] Egypt has grown closer to the current SFG administration and offered more military and counterterrorism assistance to court Somali support on GERD discussions in international institutions, where the SFG has so far remained neutral.[50] Egypt has also courted Somali support for its position on the GERD, which incentivizes it to back Somalia’s rejection of the deal.[51]

Eritrea will view an Ethiopian port on the Gulf of Aden as a threat given the high tensions between the two countries in the aftermath of the Tigray war. Eritrea allied with Abiy’s government in 2020 to destroy the Tigray People’s Liberation Front, which it views as a threat to its borders and internal cohesion.[52] It views the 2022 peace deal that ended the Tigray war as dangerous to its national security by allowing the Tigrayan People’s Liberation Front and its fighters to survive and increasing alignment between Tigray and Addis Ababa.[53] This has led Eritrea to keep forces in northern Ethiopia despite Ethiopian requests to withdraw, hampering the peace process.[54]

Many analysts view that Abiy’s statements about Ethiopia’s “natural rights” to the Red Sea and threat to use force were aimed at Eritrea, given their shared border and Ethiopia’s historical control of the port city of Assab until Eritrea gained independence in 1993.[55] Diplomats and humanitarian workers said that Ethiopia and Eritrea mobilized troops near their shared border after Abiy’s October statements.[56] An Ethiopian port will only amplify Eritrea’s longer-term concerns of Ethiopian aggression, even if it allays short-term fears of an imminent invasion.

An Ethiopian port will likely strengthen the UAE’s position in its regional rivalry with other Gulf countries, such as Saudi Arabia and Qatar, due to its strong ties with the Ethiopian government. The UAE and Saudi Arabia have increasingly competed for economic dominance over the Horn of Africa and vital waterways off its coast since 2021.[57] The Ethiopia-Somaliland deal creates another potential Emirati client port given that the UAE is a prominent backer of Abiy’s Ethiopian government and previously tried to help Ethiopia secure a stake in the Emirati-owned port in Berbera in 2019.[58] The Saudis have been wary of the Abiy government due to its UAE backing and created a Council of Arab and African littoral states on the Red Sea in 2020 that notably excluded both Ethiopia and the UAE.[59]

The UAE and Saudi Arabia led a coalition that unsuccessfully attempted to economically and politically isolate Qatar in 2017 for its alleged support for terrorism and political Islam movements that Emirati and Saudi leaders viewed as a threat to their power and stability.[60] Qatar responded by increasing ties with other countries, including states in the Horn of Africa, to offset the economic and political pressure.[61] The UAE and Saudi Arabia formally abandoned their efforts in 2021 and have been slowly mending relations since, which has created space for a growing Emirati-Saudi rivalry as both countries compete to establish themselves as global logistics and trade nodes via Red Sea ports along vital global shipping lanes.[62] This has led both countries to pursue divergent approaches on issues such as the Sudanese and Yemeni civil wars.[63]

The UAE has been a steadfast supporter of Abiy since he took power in 2018. The UAE helped broker the 2018 peace agreement between Ethiopia and Eritrea that won Abiy the Nobel Peace Prize and provided extensive military support throughout the Tigray war by establishing an air bridge.[64] The UAE also brokered a deal for partial Ethiopian ownership of its Berbera port in 2019, but the deal fell through in 2022 after Ethiopia failed to make necessary payments.[65]Sahel.

The al Qaeda–linked subgroup in central and southern Mali and northern Burkina Faso is continuing to strengthen across its area of operations. The Macina Liberation Front (MLF) launched at least three major attacks that overran state security force bases across three different regions of Mali in December 2023—including one complex attack involving an SVBIED—and was likely involved in a fourth in Burkina Faso.[66] The MLF is a subgroup of the al Qaeda–linked coalition Jama’at Nusrat al Islam wa al Muslimeen (JNIM). CTP noted that the MLF began increasing its rate of attacks in central Mali in late November and assessed that the offensive would likely create support zones that JNIM can use to launch large and sophisticated attacks in central Mali and northern Burkina Faso in the future.[67] The spate of attacks underscores the group’s ability to stage such large-scale attacks that overwhelm security forces across a large area of operations regularly.

MLF fighters overran the Malian army camp in Farabougou, Niono cercle, Segou region, central Mali, on December 12. The attack killed at least five civilians and “several dozen” soldiers.[68] Before retreating, JNIM cut internet access to the area and warned residents to not return.[69] JNIM launched an assault involving an SVBIED that it claimed overran another Malian army camp in the neighboring Mopti region of central Mali on December 20.[70] JNIM fighters then overran a Burkinabe base in northern Burkina Faso on December 24, killing dozens of state forces and looting the base before air support drove the attackers away.[71] The MLF and JNIM’s Burkinabe subgroup Ansaroul Islam overlap and sometimes work together in parts of northern Burkina Faso.[72] The MLF overran another Malian army camp in southern Mali the next day, killing another 10 soldiers and burning down the camp before retreating.[73] Regional security forces likely lack the capacity to degrade the support zones the MLF is using to stage these attacks. Malian security forces and their Kremlin-funded Wagner Group auxiliaries have given priority to fighting Tuareg rebels in northern Mali since August 2023.[74] This choice has significantly decreased the rate of counterinsurgency operations and overall security force presence in central Mali. The Armed Conflict Location & Event Data Project database shows that average monthly engagements by Malian and Wagner Group forces across central Mali decreased from 32.5 during the January–July 2023 period to 21 between August and December 2023.[75] A decrease in security force activity in the Mopti region is leading this broader downturn, as the average monthly engagements in Mopti nearly halved from 20.5 to 11 over the same period.[76] The average number of state-initiated engagements in Mopti per month—which removes roadside improvised explosive device attacks where JNIM is the instigator from consideration—has more than halved from 14.4 to 6.25.[77] These trends show that security forces are projecting less counterinsurgency pressure and are generally less active across central Mali since August, especially in the Mopti region.

Burkinabe forces have increasingly used drone strikes to compensate for their manpower shortage since April 2023.[78] The drones have improved the Burkinabe state and civilian auxiliary forces’ ability to interdict imminent attacks, but they have not stopped attacks altogether and have failed to degrade the support zones the militants use to stage these attacks.[79]

JNIM will almost certainly continue launching these attacks to delegitimize both countries’ governments and extend its support zones without establishing direct territorial control. JNIM does not seek to hold large population centers with these attacks and risks sustaining significant casualties from drone strikes by having its fighters hold their positions for too long.[80] However, the attacks enable JNIM to influence the local population despite its lack of territorial control, undermining the state’s legitimacy by showing the ineffectiveness of security forces. For example, JNIM briefly captured the military base in the besieged provincial capital of Djibo in northern Burkina Faso on November 26 and entered the town for several hours before withdrawing.[81] Burkinabe officials released footage of drone strikes that targeted the attacking militants and claimed the strikes killed hundreds.[82]

Militants will also directly intimidate and threaten civilians during the attacks. JNIM overran a military base in central Mali’s Segou region on December 12 in a town the group has besieged for at least two years and demanded that the locals permanently leave after the attack.[83] Strengthened support zones will give JNIM access to more resources and space to stage such attacks.