Angola is the second-largest total liquid fuels producer in Sub-Saharan Africa, after Nigeria, based on annual 2021 production levels. Angola’s economy is largely based on hydrocarbon production, making it vulnerable to crude oil price swings. According to the World Bank Group, Angola exited a five-year recession in 2021, and its economy continued to grow in 2022, mainly because of increased crude oil production and high oil prices.

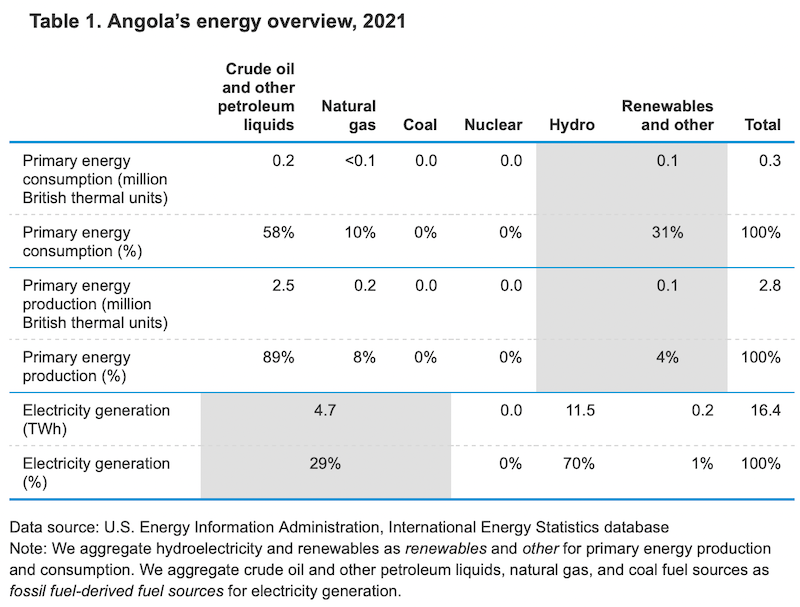

Angola primarily consumes hydroelectricity and fossil fuel-derived fuel sources (mainly natural gas) to meet its domestic needs for power generation (Table 1).1

Angola is a member of the Organization of the Petroleum Exporting Countries (OPEC) and a participant of the OPEC+ production cut agreement that began in 2016; the country also signed a new OPEC+ agreement in May 2020.

Petroleum and other liquids

Angola held an estimated 7.2 billion barrels of proved crude oil reserves at the beginning of 2022, according to estimates by the Oil & Gas Journal.2

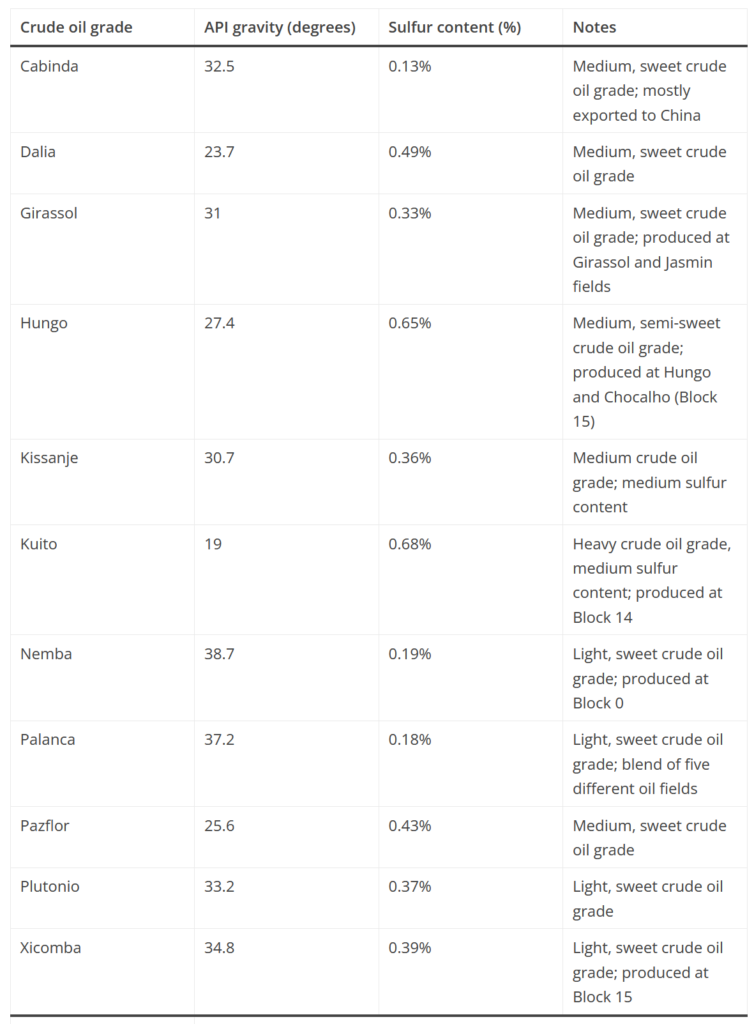

Angola’s oil fields generally produce light to medium crude oil, which has a relatively low-sulfur content (low-sulfur crude oil grades are classified as sweet). The qualities and characteristics of Angola’s crude oil grades are popular with refiners in the Asia-Pacific region (Table 2).3

Angola’s total liquid fuels production steadily declined during the past decade. In 2021, total liquid fuels production was about 1.2 million barrels per day (b/d), down from 1.8 million b/d in 2012. The downward trend in total liquid fuels production is the result of a lack of investment in upstream development. Rapid reservoir depletion and the lack of enhanced oil recovery (EOR) investments to extend the lifetime of maturing fields have also contributed to steep decline rates at some fields.4

The Angolan government aimed to attract international investors to develop its hydrocarbon resources by launching a licensing round in February 2022. The 2022 bid round offered eight exploration blocks offshore in the Lower Congo and Kwanza Basins and reportedly attracted the interest of several multinationals such as Eni, TotalEnergies, and Equinor, but for only two of the eight blocks on offer. The Angolan government is planning to launch an additional licensing round in 2023 through a limited public invitation for bids, offering four blocks in the Congo Basin and eight in the Kwanza Basin, to stimulate further investment in developing its resources.5

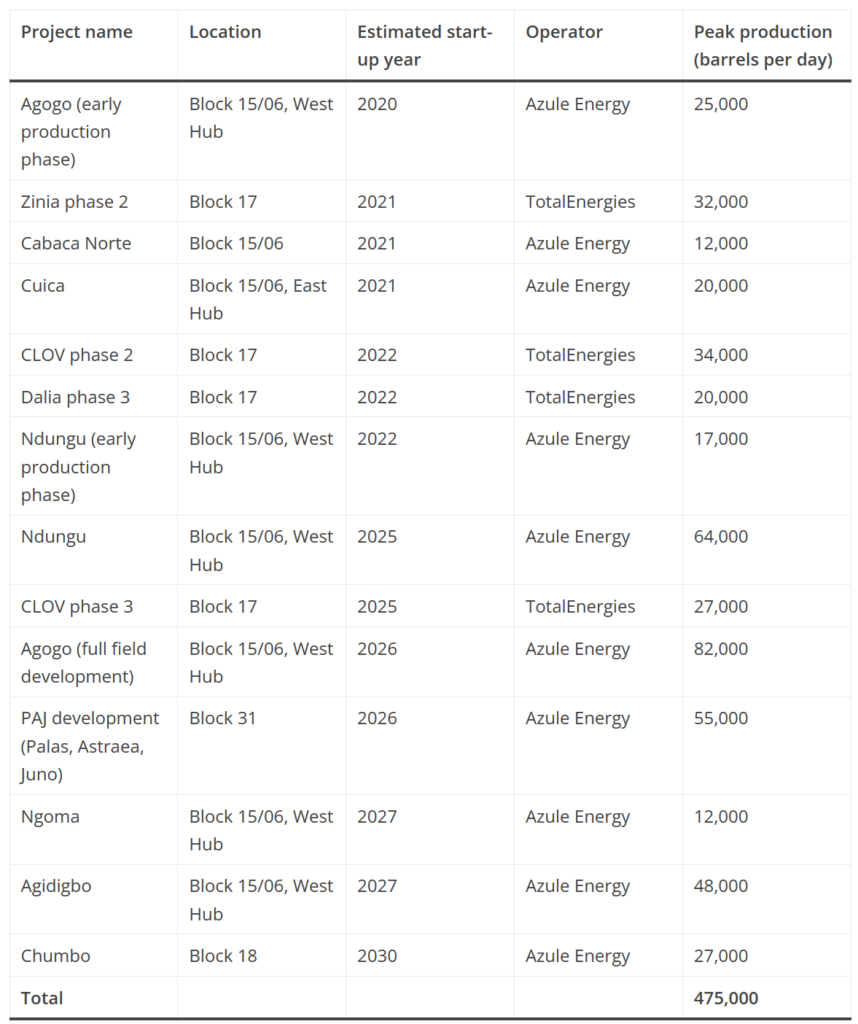

Drilling activity in Angola by major international oil companies slowed significantly in 2020 as a result of reduced capital spending, in part because of the economic slowdown from the COVID-19 pandemic. Many of Angola’s new field developments were delayed, and only a few of the new developments came online, such as the Cuica, Zinia phase 2, and Cabaca Norte projects. Although these fields increase total crude oil production, the recent additions did not offset the declines in mature fields.

We expect that many of the larger sanctioned projects such as Agogo, Ndungu, and PAJ (Palas, Astraea, Juno) will come online in the latter half of this decade and substantially increase production. Established international oil companies such as TotalEnergies or Azule Energy (a joint venture comprising BP and Eni) operate many of these new field developments or expansions (Table 3).6

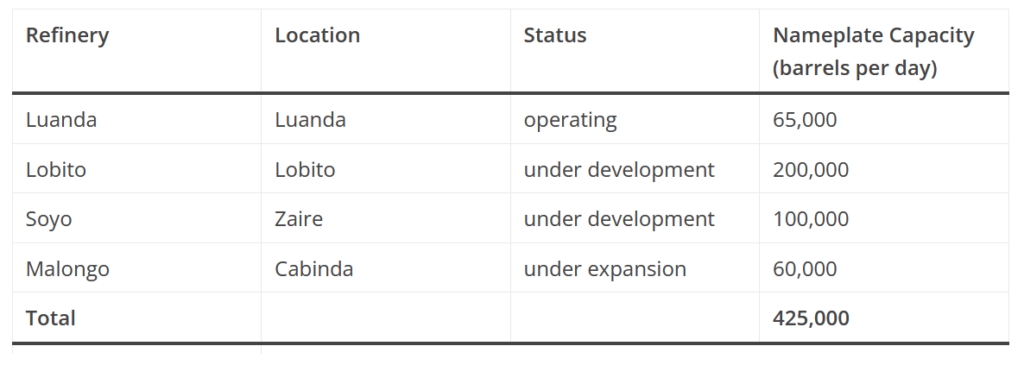

As of early 2023, Angola has only one operating refinery, which is located in the Luanda province and has a nameplate capacity of 65,000 b/d. The government announced that it is planning to expand the refinery’s capacity to 72,000 b/d through a $235 million project. The government has not yet announced additional details.

Angola has three other refineries that are under development. The Malongo refinery in the Cabinda province is undergoing a facility upgrade that will add a high-conversion unit that will enable the facility to produce diesel, gasoline, fuel oil, and jet fuel. According to Hydrocarbons Technology, the capacity upgrade is expected to be fully completed by 2Q24 and increase the refinery’s total capacity to 60,000 b/d. The construction of the 200,000 b/d Lobito refinery is scheduled to begin operations by the end of 2025; planning is still underway. In August 2020, the Angolan Ministry of Mineral Resources and Petroleum announced it was accepting bids to construct a refinery at Soyo; a contract was awarded to U.S.-based Quanten, but Quanten has not announced a completion date (Table 4).7

Natural gas

Angola held an estimated 10.6 trillion cubic feet (Tcf) of proved natural gas reserves at the beginning of 2023, according to estimates by Oil & Gas Journal.8

Angola produces small quantities of marketed natural gas, but most of its production is flared as a by-product of oil operations or is reinjected into oil fields to increase oil recovery. Angola produced an average of about 132 billion cubic feet (Bcf) of dry natural gas and consumed an average of 30 Bcf between 2012 and 202.9

Coal

Angola does not have any coal reserves, and it does not consume or produce any coal.

Electricity

In 2021, Angola had an electricity generation capacity of 7.3 gigawatts (GW) and generated 16.4 gigawatthours (GWh) of electricity, primarily from hydroelectric or fossil fuel sources. 10

The latest estimates from the World Bank indicate that 47% of Angolans had access to electricity in 2020, which is an increase of about 12% from 2010. Much of the growth in power generation has come from hydropower projects that came online in the late 2010s, but providing reliable access to end users remains a significant challenge because the transmission and distribution network in the country has not been upgraded or expanded. The distribution network also suffers from significant power loss because of illegal connections and poor enforcement of revenue collection from un-metered end users. The government of Angola aims to increase the country’s total installed capacity to 9.9 GW and its electrification rate to 60% by 2025.11

The Soyo combined-cycle natural gas turbine (CCGT) plant added 750 megawatts (MW) of total installed capacity in 2017 after plant construction and the connecting pipeline from Angola LNG were completed. The Soyo CCGT plant provides an opportunity for Angola to diversify its power infrastructure and to channel some of its natural gas production toward electricity generation. As of February 2023, an expansion project is under development and aims to add another 750 MW of generation by 2024, although the project has yet to reach a final investment decision. General Electric is reportedly supplying the dual-fired natural gas turbines for the project, which cost about $1 billion.12

Two major hydropower projects, the Cambembe expansion and the Laúca hydroelectric dam, have added substantial hydropower capacity. The second phase of the Cambembe hydropower plant, which consists of a 180 MW expansion and four new turbines, was completed in June 2017, adding 700 MW of installed capacity.13 The Laúca hydropower plant was completed in 2019, adding 2,070 MW of installed capacity after six 334 MW turbines and a 67 MW power station were installed.14

The Caculo Cabaça hydropower plant is also under development. Construction at the 2,170 MW hydropower plant started in July 2017 after it secured funding from China Gezhouba Group Co., Ltd., at an estimated $4.5 billion. According to NS Energy Business, the plant is expected to begin commercial operations by 2024.15

Energy trade

Angola is not an importer of crude oil, but it received small amounts of liquefied petroleum gas (LPG) products such as butane and propane from the United States in 2022.16

Angola exported an average of 1.5 million b/d of crude oil between 2012 and 2021. Crude oil exports declined about 450,000 b/d over the 10-year period, as a result of Angola’s declining crude oil production. In 2022, Angola exported about 1.1 million b/d of crude oil, and over half of total exports went to China, at 587,000 b/d. India was the second-largest importing country, receiving 102,000 b/d. The Netherlands (71,000 b/d) and France (55,000 b/d) received the most of other European countries. Relatively small volumes went to the Middle East (62,000 b/d) and the Western Hemisphere (5,000 b/d).17

Angola exported an average of 18,000 b/d of LPG products between 2017 and 2021, most of which was sent to Asia.18

Angola exports the natural gas it produces in the form of liquefied natural gas (LNG). Angola does not import any natural gas. We estimate that Angola exported about 102 Bcf of natural gas on average between 2012 and 2021.19

Angola exported about 165 Bcf of LNG in 2021, according to BP’s estimates in its 2022 Statistical Review of World Energy. It exported about 125 Bcf of LNG to the Asia Pacific region, and about 48 Bcf of those exports went to India, its largest importer by volume. Europe received the second-largest volume of LNG from Angola at 29 Bcf, and Spain received nearly half of that volume. The Middle East and Western Hemisphere regions imported relatively small quantities of LNG from Angola.20

Angola does not import or export any coal.

Endnotes

The World Bank Group, Angola: Country Overview, updated September 13, 2022.

“Worldwide Look at Reserves and Production,“ Oil & Gas Journal, Worldwide Report [Table], December 5, 2022.

McKinsey & Company, “Crude Grades,“ Energy Insights, accessed January 23, 2023. U.S. Energy Information Administration, “Crude oils have different quality characteristics,“ Today in Energy, July 16, 2012. “Angolan Crude Oil,“ Sonangol company website, accessed January 24, 2023.

“Nigeria and Angola lead the dramatic crude oil supply decline in West Africa,“ Rystad Energy, November 1, 2021.

“Angola’s Latest Bid Round Piques Interest of Major Operators,“ Energy Capital & Power, November 4, 2022. “Africa’s Top Licensing Rounds to Watch in 2023,“ Energy Capital & Power, December 23, 2022. “Eni, Equinor, and TotalEnergies join chase for Angolan offshore blocks,“ Rystad Energy, April 8, 2022.

Siva Prasad. “Covid-19 wreaks havoc on Angola’s plans to make an oil fortune,“ Rystad Energy, June 24, 2020. Noah Browning, et al. “Angola’s oil exploration evaporates as COVID-19 overshadows historic reforms,“ Reuters, May 20, 2020. “Total starts up the first of three new satellites in Angola’s Block 17,“ Rystad Energy, May 11, 2021.“Eni’s Cuica oilfield start-up beefs up value at Angola’s prized Block 15/06,“ Rystad Energy, August 25, 2021. “Eni and BP aim to mitigate Angola output decline through Azule Energy JV,“ Rystad Energy, March 15, 2022. “Eni poised for Angola expansion with extra volume at Ndungu,“ Rystad Energy, April 1, 2022. “Angola in the limelight as majors take FID on several offshore projects,“ Rystad Energy, September 9, 2022.

International Trade Administration, “Angola – Commercial Guide: Oil and Gas,“ Country Commercial Guides, August 5, 2022. “A Guide to Angola’s Refining Capacity,“ Energy Capital & Power, September 20, 2021. Nicholas Nhede, “Angola Commits to Increasing Oil and Gas Refining Capacity,“ Energy Capital & Power, April 20, 2022. “Cabinda Oil Refinery, Malembo Plain,“ Hydrocarbons Technology, accessed January 23, 2023.

“Worldwide Look at Reserves and Production,“ Oil & Gas Journal, Worldwide Report [Table], December 5, 2022.

U.S. Energy Information Administration, International Energy Statistics database, accessed January 18, 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed January 18, 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed January 18, 2023. World Bank Group, World Bank Open Data Portal, accessed January 20, 2023. World Bank Group, “Angola – Systematic Country Diagnostic: Creating Assets for the Poor,“ December 1, 2018. International Trade Administration, “Angola – Energy,“ August 22, 2019. “Hydropower to continue to dominate Angola power generation through 2035,“ Power Technology, April 8, 2022.

International Trade Administration, “Angola – Energy,“ August 22, 2019. “Soyo II Combined Cycle Power Plant, Angola,“ Power Technology, December 2, 2021.

“Angola inaugurates Plant II of the Cambembe Hydroelectric Facility,“ www.macauhub.com, June 30, 2017.

“Angola’s Lauca dam starts producing power,“ African Review of Business and Technology, July 28, 2017. “Construction of Laúca, Angola, completed this year,“ Macauhub.com.mo, February 11, 2019. “Angola’s pride: the Laúca hydropower station,“ The Energy Year, September 23, 2021.

Michael Harris, “Angolans officials break ground on 2,170-MW Cacula Cabaca hydropower plan, generation begins at 2,070-MW Lauca,“ Hydro Review, August 7, 2017. “Caculo Cabaça hydropower plant project in Kwanza Norte Province, Angola,“ Africa Energy Portal, October 20, 2021. “Caculo Cabaça Hydropower Project,“ NS Energy Business, accessed January 20, 2023.

Kpler liquefied petroleum gas products database, accessed January 30, 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed November 1, 2022. Kpler crude oil flows database, accessed January 11, 2023.

Kpler crude oil flows database, accessed January 11, 2023.

U.S. Energy Information Administration, International Energy Statistics database, accessed January 18, 2023.

BP, 2022 Statistical Review of World Energy, 71st edition, June 2022.